Best Reward Cards in India

From groceries to fuel to movies, rewards cards help you earn cash, points or miles from your everyday purchases. You can redeem your rewards for cash, shopping or travel. We analyzed different reward cards to give you the best recommendations. You'll learn how to choose the best rewards credit card for your lifestyle. The best rewards credit cards are about as rewarding as they’ve ever been, offering signup bonuses and with reward rates upto 2%+ on purchases.

- Get 4 points online

- Get 2 points on others

- 2 Reward Points on ₹150 spent. 2 X Reward Points on online spends.

- Redeem Reward points as CashBack on your MoneyBack Credit Card (100 Reward Points = ₹20)

- Zero Lost Card liability post reporting of the loss of card

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to ₹50 Lakhs*

- Free Fire and Burglary protection for goods above ₹5000 for 180 days

- Spend Milestone Offer

- Spend ₹50,000 in a Quarter and get ₹500 E-Voucher

- Get discount on movie ₹4,000 or more in a year

- Get a discount on dining ₹9,600 or more in a year

- Save ₹600 on Fuel Surcharge waiver in a year

- Get started on an entertaining journey with a range of gift vouchers for shopping, apparel, dining, and many more categories

- 25% off on movies and up to 20% off on dining. (at participating outlets).

- Earn Bouquet of discount vouchers as Welcome Bonus

- 3 Reward Points (RP) on Rs. 150 spent. 10 RP on dining spends on weekdays (Mon-Fri).

- Get movie discounts of Rs. 4,000 or more in a year!

- Earn big discounts of Rs. 9,600 or more every year on dining!

- Save Rs. 600 in a year on your fuel transactions

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to 50 Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days

- Earn 2 Points for every ₹150 you spend

- Weekday Dining Bonanza – Earn 5 Points* on every ₹150 spent on Weekday Dinings.

- Get movie discounts of ₹4,000 or more in a year!

- Earn big discounts of ₹9,600 or more every year on dining!

- Save ₹600 in a year on your fuel transactions

- Get started on an entertaining journey with a bouquet of Gift Vouchers, across Shopping, Apparel, Dining and many more categories.

- 25% off on movies and up to 15% off on dining. (at participating outlets)

- Bouquet of discount vouchers as welcome gift

- 2 Reward Points on ₹150 spent. 5 RP on dining spends on weekdays (Mon-Fri)

- Get movie discounts of ₹4,000 or more in a year!

- Earn big discounts of ₹7,500 or more every year on dining!

- Save ₹300 in a year on your fuel transactions

-

Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to ₹50 Lakhs*

- Free Fire and Burglary protection for goods above ₹5000 for 180 days

- 1,500 on your first spend within 30 days of card issue.

- 1,000 on your first spend of Rs.1000 within 60 days of card issue.

- Up to 15% savings across participating restaurants

- Easy EMI options at more than 2,000 outlets

-

Get benefits worth Rs 4800+ in first year

- Fee waiver of Rs 1000 on annual spends of Rs 30000

- Points worth Rs 850^ on card activation

- Additional points worth Rs 2950**

- Never - expiring reward points

- Instantly Pay with Points at select partners

- Simply tap and pay using a contactless card

- 2 reward points on all

- 20 reward points on snapdeal purchases through SmartBUY

- Flat 5% Instant Discount when you shop at Snapdeal

- Free Accidental Death Insurance up to 50 Lakhs

- Snapdeal Vouchers worth Rs. 2000

- Earn 500 Reward Points

- 2 Reward Points per Rs. 150 spent on all purchases

- Flat 5% Instant Discount when you shop at Snapdeal

- Earn 20 Reward Points when you shop at Snapdeal and purchases through SmartBUY

- A fuel surcharge of 2.5% plus service tax will be replaced by Convenience fee of 1%

- Avail up to 50 days of interest-free period from the date of purchase

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to 50 Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days

- 3 reward points on all

- 4.5 reward points on dining

- Spend over 5 lac on your card and earn an Air voucher worth Rs. 8,000.

- Free Accidental Death Insurance up to 50 Lakhs

- 2.5% plus service tax will be replaced by Convenience fee of 1%

- 3 Reward Points on every Rs 150 spent.

- Get 50% more points on dining spend.

- Spend over 5 lac on your card and earn an Air voucher worth Rs. 8,000.

- Get the first-year fee reversed if you spend Rs. 15,000 in the first 90 days of card setup date and renewal fee reversed if you spend Rs. 1,00,000 in a year prior to the renewal date

- Doctor’s Superia Travel Club

- 1) International Miles - Enjoy redemption of Reward Points at over 20 international airlines through KrisFlyer - Singapore Airlines Frequent Flyer Program.

- Enjoy redemption of Reward Points against air miles on Jet Airways

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to 50 Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days*

- 2 reward points on all

- 6 reward points on weekend shoppings

- 500 Bonus Reward Points on Teacher's Day

- Free Accidental Death Insurance up to 50 Lakhs

- 2.5% plus service tax will be replaced by Convenience fee of 1%

- 2 Reward Points per Rs. 150 spent on all purchases

- Earn 6 Reward Points on weekend shopping

- 500 Bonus Reward Points on Teacher's Day

- A fuel surcharge of 2.5% plus service tax will be replaced by Convenience fee of 1%

- Avail up to 50 days of the interest-free period from the date of purchase

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to 50 Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days

- 3 reward points on all

- 50% more reward points on dining and grocery

- ₹1000 Shopping vouchers on ₹75,000 spends every 6 months

- Free Accidental Death Insurance upto 50 Lakhs

- Earn 1000 Reward Points.

- 3 Reward Points per Rs. 150 spent on all purchases

- 50% more Reward Points on dining and grocery spends

- Get Rs. 1,000 Shopping vouchers on Rs. 75,000 spends every 6 months.

- A fuel surcharge of 2.5% plus service tax will be replaced by Convenience fee of 1%

- Avail up to 50 days of the interest-free period from the date of purchase

- Redeem Reward Points as Cash Back against outstanding amount on your Credit Card (100 Reward Points = Rs. 20)

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to 50 Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days

- 3 PAYBACK points on all(except fuel)

- 6 PAYBACK point on International spends

- 2 complimentary movie tickets every month under the Buy One Get One Free offer

- 15% savings on dining bills at over 2500+ restaurants

- Vouchers on Shopping and Travel worth Rs 5000

- 15,000 PAYBACK Points every anniversary year

- Get Welcome Vouchers on Shopping and Travel worth Rs 5000 on payment of joining fee.

- Earn up to 15,000 PAYBACK Points every anniversary year.

- Get up to 2 complimentary rounds of golf every month at the golf course of your choice based on eligible spends on your card.

- 2 complimentary domestic airport lounge visits per quarter, courtesy of Mastercard and American Express.

- Get the all-new feature of 2 complimentary domestic railway lounge visits per quarter, courtesy Mastercard and American

- 2 complimentary movie tickets every month under the Buy 1 Get 1 offer through www.bookmyshow.com on first come first serve basis.

- Earn 2X Points on all international transactions on your card.

- Minimum 15% savings on dining bills at over 2,500+ restaurants across India through Culinary Treats Programme

- 2 PAYBACK points on all(except fuel)

- 1 PAYBACK point on utilities and insurance categories

- 1% fuel surcharge waiver

- Minimum 15% savings on dining at over 800 restaurants

- Built-in contactless technology to make quick and secure payments at retail outlets

- Security of a chip card to protect you against the risk of fraud.

- PAYBACK Points, redeemable for exciting gifts and vouchers.

- Fuel surcharge waiver.

- Minimum 15% savings on dining at over 800 restaurants courtesy our Culinary Treats program.

- 10% back on AC1, AC2, AC3, AC CC as reward points for your ticket purchase on irctc

- Get 1 Reward point for every ₹125 spent on non-fuel retail purchases

- Get 350 activation bonus Reward Points on single transaction of ₹500 or more within 45 days of card issuance.

- Save 1.8% transaction charges on railway ticket bookings

- Enjoy freedom from paying the 1% fuel surcharge across all petrol pumps in India

- Buy tickets through irctc.co.in for AC1, AC2. AC3 and AC CC and earn upto 10% Valueback as Reward points.

- Save 1.8% transaction charges on railway ticket bookings

- Get 350 activation bonus Reward Points on single transaction of ₹500 or more within 45 days of card issuance.

- Enjoy freedom from paying the 1% fuel surcharge across all petrol pumps in India

- Get 1 Reward point for every ₹125 spent on non-fuel retail purchases

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Welcome e- Gift Voucher worth ₹1,000 from STAR

- 3.5% value back on spends at STAR Outlets

- Upto 5% value back on spends on select TATA Outlets

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Welcome e- Gift Voucher worth ₹1,000 from STAR

- 3.5% value back on spends at STAR Outlets

- Upto 5% value back on spends on select TATA Outlets

- Spend based fees reversal on spends of ₹1,00,000 & above annually

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Get 500 Empower Points worth ₹500 on total spends of ₹2,000

- Get 1.5% value back on spends at Croma

- Get up to 5% value back on spends on Tata outlets

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Get 500 Empower Points worth ₹500 on total spends of ₹2,000

- Get 1.5% value back on spends at Croma

- Get up to 5% value back on spends on Tata outlets

- Get your annual fee waived off, on spending ₹1,00,000 or more in a year

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Welcome e- Gift Voucher worth ₹3,500 from STAR

- Anniversary e- Gift Voucher worth ₹3,000 from STAR. Eligibility on crossing spends of ₹2 lakhs in the previous year

- 3.5% value back on spends at STAR Outlets

- Upto 5% value back on spends on select TATA Outlets

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Welcome e- Gift Voucher worth ₹3,500 from STAR

- Anniversary e- Gift Voucher worth ₹3,000 from STAR. Eligibility on crossing spends of ₹2 lakhs in the previous year

- 3.5% value back on spends at STAR Outlets

- Upto 5% value back on spends on select TATA Outlets

- STAR e- Gift Vouchers worth ₹3,000 on spends of ₹4 lakhs and ₹5 lakhs each

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- e- Gift Voucher worth ₹3,000 from any of the following brands: Yatra, Hush Puppies / Bata, Aditya Birla Fashion, Westside

- Anniversary Gift: Eligibility on crossing spends of ₹2 lakhs in the previous year

- Get 2% value back on spends at Croma

- Get up to 5% value back on spends on Tata outlets

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- e- Gift Voucher worth ₹3,000 from any of the following brands: Yatra, Hush Puppies / Bata, Aditya Birla Fashion, Westside

- Anniversary Gift: Eligibility on crossing spends of ₹2 lakhs in the previous year

- Get 2% value back on spends at Croma

- Get up to 5% value back on spends on Tata outlets

- Get spend rewards on annual spending of ₹4 lakhs and 5 lakhs, each

- 6 Delight points for every ₹100 spent on travel

- Get 3 Delight points on others

- Welcome bonus 4000 Delight points

- Complimentary Visa Airport Lounge Access

- Earn 6 Delight Points for every ₹100 you spend on travel related expenses viz. Hotels, Airlines, IRCTC, Bus Bookings etc. or earn 3 Delight Points on every other spent

- Additionally you will earn a welcome gift of 4000 Delight Points on your first transaction of minimum 1500 within 60 days of receiving your card.

- Enjoy interest free credit of up to 48 days* on your purchases and manage your payments as per your convenience

- Waiver of 1%* fuel surcharge every time you fill fuel using IDBI Bank Royale Signature Card across all fuel stations for transactions in the range of 400 to 5000

- Air Travel Accident Insurance Cover for a value of 25 lakhs is provided.

- Complimentary Visa Airport Lounge Access.

- Zero Lost Card Liability is offered in case of theft or loss of card.

- 2 Free Movie Tickets per month any day of the week on BookMyshow

- Convert Delight Points into cashback

- Double Delight Points in your birthday month!

- 4 points for every ₹200 spent.

- 20 points on shopping during weekends for every ₹200 spent

- 40 points on dining during weekends for every ₹200 spent.

- 100 points

- Movie ticket booking made using the My Zone Credit Card will make you eligible for a 25% discount on the total booking account

- Movie ticket booking made using the My Zone Credit Card will make you eligible for a 25% discount on the total booking account.

- Any purchase above ₹2,500 made using the card can be converted into easy monthly instalments by contacting the bank.

- Axis My Zone Credit Card users can enjoy 4 complimentary visits per year to participating airport lounges within India.

- MY ZONE customers will earn 1000 bonus EDGE REWARD points on spending min ₹30,000 per calendar quarter.

- 4 points for every ₹200 spent.

- 20 points on shopping during weekends for every ₹200 spent.

- 40 points on dining during weekends for every ₹200 spent.

- Under Axis Banks Dining Delights programme, you enjoy a minimum 15% off on dining bills at select restaurants in the country.

- My Zone credit cardholders can avail up to ₹1,000 off on Myntra. One has to use coupon code MYZONE1000 at the time of checkout.

- 100 points will be credited when the card is used for online shopping for the first time

- 1st Year fee Waived on spending ₹5,000 within 45 days

- 2 points for every ₹200 spent.

- Jabong gift voucher worth 500

- BookMyShow voucher worth 300

- Amazon Voucher worth 250

- 10% off on movies, recharges and online shopping

- 2 points for every ₹200 spent.

- Jabong gift voucher worth 500

- BookMyShow voucher worth 300

- Amazon Voucher worth 250

- Any purchase amounting to ₹2,500 or higher can be converted into monthly instalments.

- You can enjoy up to 15% off on dining bills at partner restaurants located across India.

- Neo credit card offers 10% discount on Myntra, BookMyShow, Freecharge and redBus.

- Movie ticket bookings on BookMyShow gives you a discount of 10%, with monthly benefits up to Rs.50.

- The redemption value of 1 reward point is ₹0.20

- 10 points for every ₹200 spent.

- The Axis Bank Privilege Cedit Card comes with an activation benefit of Yatra voucher worth ₹5,000

- On spending ₹2.5 Lakh in a year, the cardholder can get Yatra vouchers worth double the eDGE reward points accumulated

- The Axis Bank Privilege Cedit Card comes with an activation benefit of Yatra voucher worth ₹5,000 and 8 complimentary lounge access at selected domestic airports

- On spending ₹2.5 Lakh in a year, the cardholder can get Yatra vouchers worth double the eDGE reward points accumulated.

- 10 Points on every ₹200 spend

- Convert your Credit Card purchase of ₹2,500 or more into EMI

- 1% Fuel Surcharge Waiver on monthly fuel spends

- Up to 20% discount on select restaurants which come with the Dining Delights scheme.

- Every instance of card renewal would give you up to 3,000 eDGE reward points

- 2.5% fuel surcharge waiver, for a minimum transaction amount of ₹400 and a maximum of ₹4000. Maximum benefits upto ₹400 per month

- The card also offers air accident cover of up to Rs. 2.5 Crore. Purchase protection covers and credit shield cover of 1 Lakh each are also offered to the user.

- 5% Cashback on Flipkart, Myntra, and 2GUD spends.

- 4% Cashback on MakeMyTrip, Goibibo, Uber, PVR, Curefit, and UrbanClap spends.

- 1.5% Cashback on others

- ₹3,300 worth of joining activation benefits.

- Enjoy 4 complimentary lounge visit to select airport lounges.

- 5% Cashback on Flipkart, Myntra, and 2GUD spends.

- 4% Cashback on MakeMyTrip, Goibibo, Uber, PVR, Curefit, and UrbanClap spends.

- 1.5% Cashback on others

- ₹3,300 worth of joining activation benefits.

- Enjoy 4 complimentary lounge visit to select airport lounges.

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Spend ₹1000 4 times a month and get 1000 Bonus points for first 5 months

- Redeem your Points from the fabulous 18 and 24 Karat Gold Collection

- Earn Welcome Gift of 4,000 Bonus Membership Rewards Points

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Spend ₹1000 4 times a month and get 1000 Bonus points for first 5 months

- Earn Welcome Gift of 4,000 Bonus Membership Rewards Points

- Joining Fee - ₹1,000

- Second Year onwards ₹4,500

- Spend ₹1.5L in 12 Months and get Renewal Fee waived for next renewal year

- Redeem your Points from the fabulous 18 and 24 Karat Gold Collection

- 18,000 MR points / 18 Karat Gold Collection

- Taj voucher worth ₹9,000

- American Express Domestic Travel e-voucher worth ₹7,000

- Amazon e-voucher worth ₹7,000

- Statement Credit worth ₹6,000

- 24,000 MR points / 24 Karat Gold Collection

- Taj voucher worth ₹14,000

- Tanishq voucher worth ₹10,000

- Statement Credit worth ₹9,000

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- 0% Convenience fee on fueling up at HPCL

- Welcome Gift of 5,000 Milestone Bonus Membership Rewards Points redeemable for Travel Vouchers worth ₹4,000

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- 0% Convenience fee on fueling up at HPCL

- Welcome Gift of 5,000 Milestone Bonus Membership Rewards Points redeemable for Travel Vouchers worth ₹4,000

- Spend ₹1.90 Lacs in a year and you can get Travel Vouchers worth more ₹7,700

- Spend ₹4 Lacs in a year and get a E-Gift Card worth ₹10,000 from Taj Group and also get Travel Vouchers worth ₹11,800

- Enjoy complimentary membership to Priority Pass, with the US$99 annual membership fee waived off

- Enjoy 4 complimentary airport lounges visits per year

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Redeem your Points from the fabulous 18 and 24 Karat Gold Collection

- Earn Welcome Gift of 4,000 Bonus Membership Rewards Points

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Earn Welcome Gift of 4,000 Bonus Membership Rewards Points

- Joining Fee - ₹1,000

- Second Year onwards ₹4,500

- Earn 5,000 Membership Rewards Points upon First Year Card Renewal

- Redeem your Points from the fabulous 18 and 24 Karat Gold Collection

- Spend ₹1000 6 times a month and get 1000 Bonus points every month

- Enjoy up to 20% off every time you dine at select restaurant partners.

- 18,000 MR points / 18 Karat Gold Collection (Spend ₹3 Lakhs)

- Taj voucher worth ₹9,000

- American Express Domestic Travel e-voucher worth ₹7,000

- Amazon e-voucher worth ₹7,000

- Statement Credit worth ₹6,000

- 24,000 MR points / 24 Karat Gold Collection (Spend ₹6 Lakhs)

- Taj voucher worth ₹14,000

- Tanishq voucher worth ₹10,000

- Statement Credit worth ₹9,000

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Spend ₹25,000 and more in a calendar month get BookMyShow Voucher worth ₹500 or Flipkart Voucher worth ₹500

- Earn Welcome Gift of 11,000 Bonus Membership Rewards Points

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Spend ₹25,000 and more in a calendar month get BookMyShow Voucher worth ₹500 or Flipkart Voucher worth ₹500

- Earn Welcome Gift of 11,000 Bonus Membership Rewards Points

- Joining Fee - ₹5,000

- Second Year onwards ₹10,000

- Enjoy 12 complimentary visits in a year (limited to 3 visits per quarter) to American Express lounges and other domestic airport lounges across India

- Air Accident Insurance of ₹1 Crore

- 4 free Supplementary Cards and 1 Additional Card

- Earn 7 First Citizen Points per ₹100 spent on private label brands at Shoppers Stop

- Earn 5 First Citizen Points per ₹100 spent on other brands at Shoppers Stop

- Earn 1 First Citizen Points per ₹100 spent on other

- Spend ₹30,000 in 12 Months and get Renewal Fee waived for next renewal year

- Welcome and First-Year benefits worth ₹2,050

- 7 First Citizen Points/₹100 spent on private label brands at Shoppers Stop

- 5 First Citizen Points/₹100 spent on other brands at Shoppers Stop

- 1 First Citizen Point/₹100 on other spends

- 1 First Citizen Point = ₹0.6 Instantly redeem your First Citizen Points to shop at Shoppers Stop

- Welcome and First-Year benefits worth ₹2,050

- 2 Shoppers Stop vouchers worth ₹250 each redeemable at Shoppers Stop. Each voucher can be redeemed against a minimum spends of ₹2,500 at Shoppers Stop.

- Home Stop voucher worth ₹500 redeemable at Home Stop outlets. The voucher can be redeemed against a minimum spend of ₹4000 at Home Stop.

- Shoppers Stop online store voucher redeemable on shoppersstop for savings of ₹250 on purchases worth ₹1,500 or above. Click here for offer details and terms and conditions.

- Spend anywhere within 30 days of Card issuance and get 500 Reward Points worth ₹300 on your First Citizen Citi Credit Card. Click here for offer details and terms and conditions.

- Joining Fee - ₹500 and Second Year onwards ₹500

- Get 500 First Citizen points worth ₹300 on your first spend within 30 days of card issuance

- Zero Annual fee on annual spends of ₹30,000 or more

- Get Rs. 1000 cash back on spends of ₹5,000 in 60 days of card issuance

HDFC Bank MoneyBack Card

Rewards Rate

- For every ₹150 you spend

Milestone Offer

Get ₹500 e-Voucher on spending ₹50,000 in a Quarter

Fee

₹0

Fuel Surcharge waiver

1% Fuel Surcharge waived off on fuel transactions.

Card Brand

Card Details

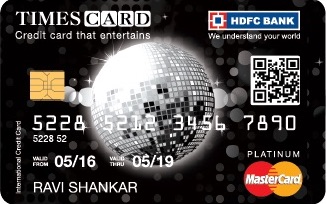

HDFC Platinum Times Card

Rewards Rate

- For every ₹150 you spend, earn 3 reward points and 10 reward points on weekday dining

Benefits

Fee

₹1,000

SignUp Bonus

Card Brand

Card Details

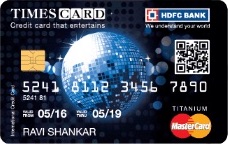

Titanium Times Card

Rewards Rate

Benefits

Fee

₹500

SignUp Bonus

Card Brand

Card Details

Citi Rewards Card

Reward Rate

Earn 10X Reward Points on spends at apparel and department stores; Earn 1 Point for every Rs. 125 on all other purchases; Get 300 bonus points on card spends of INR 30,000 or more in a month;

SignUp Bonus

- Earn up to 2500 points

Fee

₹1,000

Privileges

Card Brand

Card Details

Snapdeal HDFC Credit Card

Rewards Rate

- For every ₹150 you spend

Benefits

Fee

₹500

SignUp Bonus

Card Brand

Card Details

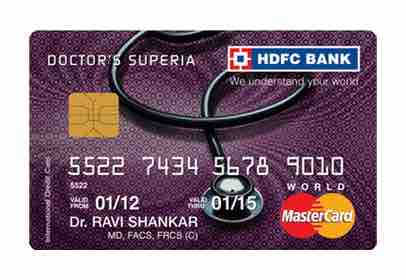

Doctors Superia

Rewards Rate

- For every ₹150 you spend

Benefits

Fee

₹1,000

Fuel Surcharge waiver

Card Brand

Card Details

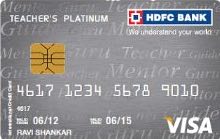

Teachers Platinum

Rewards Rate

- For every ₹150 you spend

Benefits

Fee

₹500

Fuel Surcharge waiver

Card Brand

Card Details

HDFC Solitaire Credit card

Rewards Rate

- For every ₹150 you spend

Benefits

Fee

₹500

Welcome Benefits

Card Brand

Card Details

Rubyx Credit Card

Rewards Rate

- For every ₹100 you spend

Benefits

Fee

₹3,000

Welcome Bonus

Card Brand

Card Details

- Enjoy privileges across lifestyle, dining, and golf; get travel benefits and free movie tickets.

ICICI Platinum Chip Credit Card

Rewards Rate

- For every ₹100 you spend

Benefits

Fee

₹199

Special

Card Brand

Card Details

IRCTC SBI Platinum Card

Rewards Rate

SignUp Bonus

Fee

₹500

Benefits

Card Brand

Card Details

SBI TATA STAR Titanium Card

Rewards Rate

SignUp Bonus

Fee

₹499

Value Back

Card Brand

Card Details

SBI TATA Titanium Card

Rewards Rate

SignUp Bonus

Fee

₹499

Value Back

Card Brand

Card Details

SBI TATA STAR Platinum Card

Rewards Rate

SignUp Bonus

Fee

₹2,999

Value Back

Card Brand

Card Details

SBI TATA Platinum Card

Rewards Rate

SignUp Bonus

Fee

₹2,999

Value Back

Card Brand

Card Details

IDBI Bank Euphoria Credit Card

Rewards Rate

SignUp Bonus

Fee

₹1,499

Airport Lounge Access

Card Brand

Card Details

Axis Bank MY Zone Easy Credit Card

Rewards Rate

SignUp Bonus

Fee

₹500

Benefits

Card Brand

Card Details

Axis Bank Neo Credit Card

Rewards Rate

SignUp Bonus

Fee

₹250

Benefits

Card Brand

Card Details

Axis Bank Privilege Credit Card

Rewards Rate

SignUp Bonus

Fee

₹1,500

Milestone Bonus

Card Brand

Card Details

Axis Bank Flipkart Credit Card

Rewards Rate

SignUp Bonus

Fee

₹500

Milestone Bonus

Card Brand

Card Details

American Express Membership Rewards Credit Card

Rewards Rate

Gold Collection

Fee

₹1,000

SignUp Bonus

Card Brand

Card Details

American Express Platinum Travel Credit Card

Rewards Rate

Fuel Surcharge waiver

Fee

₹3,500

SignUp Bonus

Card Brand

Card Details

American Express Gold Credit Card

Rewards Rate

Gold Collection

Fee

₹1,000

SignUp Bonus

Card Brand

Card Details

American Express Platinum Reserve Credit Card

Rewards Rate

Monthly Voucher

Fee

₹5,000

SignUp Bonus

Card Brand

Card Details

First Citizen Citi Credit Card

Rewards Rate

Fee Wavier

Fee

₹500

SignUp Bonus

Card Brand

Card Details

EDITORIAL PICKS - BEST REWARD CREDIT CARDS

ICICI Rubyx Credit Card has a joining fee of ₹3,000 and a renewal fee of ₹2,000 from the second year onwards. The renewal fee is waived off if you spend more than ₹3,00,000 in the previous year. You get welcome vouchers on shopping and travel worth ₹5,000 within 30 days from the date of payment of joining fees.Rubyx credit card provides several rewards such as earn up to 6 PAYBACK points on every ₹100 spent, 2 complimentary movie tickets every month under the “Buy One Get One Free” offer, and 15% savings on dining bills at over 2500+ restaurants. On your card anniversary date if you have reached the spending limit then your renewal fee is waived off or you get up to 15,000 PAYBACK points.

Rubyx credit card also provides free access to airport lounges and golf course access, you get up to 2 complimentary rounds every month at the golf course of your choice and 2 complimentary domestic airport lounge access per quarter, courtesy of Mastercard and American Express.

Axis Bank Privilege Credit Card has a joining fee of ₹1,500 and comes with a welcome benefit of Yatra voucher worth ₹5,000 and 8 complimentary lounge access at selected domestic airports at the time of card activation. When you spend more than ₹2.5 Lakh in a year, the cardholder gets Yatra vouchers worth double the EDGE reward points accumulated.

Axis Bank Privilege offers 10 points for every ₹200 spent and an easy conversion option to EMI. You can convert any purchase of ₹2,500 or more into easy EMIs. If you commute to work and have good fuel spending, Axis Bank Privilege also offers 1% fuel surcharge waiver on your monthly fuel expenses. This card also offers a Dining Delights scheme under which you get up to 20% discount on select restaurants.

While Axis Bank Privilege credit card charges renewal fee and does not offer fee waiver based on your spending but you get up to 3,000 EDGE reward points when you renew your card for the next year.

American Express Platinum Reserve Credit Card has a joining fee of ₹5,000 + GST and a renewal fee of ₹10,000 + GST from the second year onwards. Earn 2 membership reward points for every ₹100 spent on most of your spendings except on fuel, insurance payments, and utility payments.

You get a welcome gift of 11,000 bonus membership reward points and a ₹500 worth voucher from either BookMyShow or Flipkart when you spend ₹25,000 and more in a calendar month.

If you are a frequent traveler then the American Express Platinum Reserve credit card offers one of the highest complimentary airport lounge accesses among credit cards with up to 12 complimentary visits in a year (limited to 3 visits per quarter) to American Express lounges and other domestic airport lounges across India. You also get Air Accident Insurance of ₹1 Crore.

American Express Gold Credit Card has a joining fee of ₹1,000 + GST and a renewal fee of ₹4,500 + GST from the second year onwards. You get 2 membership reward points for every ₹100 spent on most of your spendings except on fuel, insurance payments, and utility payments.

When you apply for the credit card you earn a welcome gift of 4,000 bonus membership rewards points and additional 5,000 membership rewards points upon first-year card renewal. Spend ₹1000 6 times a month to get an additional 1000 bonus points every month. Enjoy up to 20% off every time you dine at select restaurant partners.

18,000 MR points / 18 Karat Gold Collection (Spend ₹3 Lakhs)

- Taj voucher worth ₹9,000

- American Express Domestic Travel e-voucher worth ₹7,000

- Amazon e-voucher worth ₹7,000

- Statement Credit worth ₹6,000

- Taj voucher worth ₹14,000

- Tanishq voucher worth ₹10,000

- Statement Credit worth ₹9,000

CREDIT CARD BEST PRACTICES

Should I use only one credit card?

Though managing one credit card is easy so that you can keep your spending and payments manageable, using a single card in most cases does not provide the best overall benefit. It is a choice you make between easy maintenance and enjoying overwhelming rewards. Because not all cards are made to provide equal benefits, every card is unique and card issuers partner with service providers to offer specialized offers, so it is advisable to do the math to see if utilizing more than one credit card offers you an overall best reward.For example, if you have 2 credit cards one will give the best value for fuel and another card gives the best cashback on groceries, departmental store, and payments to utility bills. You can maximize your benefits by using two best cards from the respective category.

Maintain a credit utilization below 30%

Just because you have a high spending limit doesn't mean you should use all of it, keeping the utilization below 30% can help you maintain a high credit score. It is not only to maintain a high credit score, but you are also advised to have lower utilization of your credit, having a buffer on your credit limit can help you out during emergency situations, though 100% utilization cards affect your credit score.Redeem your rewards regularly

We all save for the future but rewards have an expiration and in some cases, you won't even remember you have rewards. So making a habit of redeeming your rewards regularly is as important as choosing the right credit card that offers you the best rewards. There is no point in finding the right card if you don't utilize the benefits offered. Usually, most of the credit cards have a reward expiry of 2 years, so better use it to recharge your phone or redeem a gift card of your favorite store. If you have long term goals like a vacation trip, you can accumulate enough points to pay for a plane ticket to your vacation trip.If your reward card has a redeemed option of a statement credit or direct deposit to your bank then redeem it as soon as you hit the minimum redemption amount.

Pay credit card monthly balance on time

The rule of thumb for maintaining a good credit score is to pay your monthly dues on time. Regularly paying monthly dues not only helps your credit score but also helps you avoid paying late fees and accumulating interest.When you should not apply for a credit card?

Credit cards are always rewarding, so why should one not apply for a credit card. There are situations where you need other factors before applying for a credit card. Looking for short term benefits and not considering your long term financial needs such as your plans on availing car or home loans. Because applying for a new credit card will have an impact on your credit score as issuers do a credit inquiry during your application processing. But this impact may not be in a bad way though you will see a drop in your credit score due to inquiry having a credit card increases your credit limit and increases your creditworthiness, so it is always better to plan ahead based on your long term goals and not just short term benefits. The rule of thumb is to not apply for any new credit cards if you are planning for a car or home loan within the next 6 months.HOW TO PICK THE BEST REWARD CREDIT CARD

With so many credit cards offering a wide variety of rewards, by picking any card means you are losing a whole lot of fun. While credit card offers keep changing and your spending habits change it is always better to re-evaluate your current cards and apply new ones. But choosing the right one is not always easy unless you follow the process. You have to choose between reward points or miles, signup/welcome bonus, and other perks.Follow these steps to choose the best rewards credit card

Pick your reward type?

Before choosing the credit card, choose your reward type. Do you want to encash your rewards as cash like a statement of credit or direct deposit to your bank? Are you a frequent traveler and regularly need lounge accesses and deals on hotel stayings? Are you a movie buff? Do you dine-in regularly? So the first and foremost important step is to identify what type of spending habits you have and what is the preferred reward experience you like. Credit card offers free lounge access, discounts on hotel stays and complimentary breakfast, and other services. Free flight tickets on signup bonus or milestone spendings.Determine how you want reward points

If you like shopping choose cards that offer rewards that can be redeemed as gift cards for your favorite stores. If you are a frequent traveler then choosing these reward points as miles means you can redeem on your future bookings or upgrades to a higher class. You can also choose a flat reward rate like 3% on every spending or any bonus categories like shopping online on Amazon or Flipkart that offer high reward rates. Sometimes there are also promotional offers that offer great deals and are valid only for certain months.Signup bonus and perks

Most reward credit cards offer some kind of signup bonus to new cardholders and the minimum offer you can get is equal to the worth of the yearly joining fee. To qualify for the signup bonus either you have to use a minimum number of transactions or spend a minimum amount using the card within a specified time frame.Lastly, take a look at the extra features and perks available to cardholders beyond the reward earnings. These perks include free Airport lounge access, free golf courses, buy one get one movie tickets or shows, trip cancellation insurance, free checked baggage for your flights, free hotel stay or discount on hotel or resort, free memberships to your favorite clubs, gyms.