All Credit Card Offers

Quick and Easy. We've done the research on the top credit card offers for May 2019

- Get 6 points on Dining, Hotels & Telecom

- Get 2 points on others

- ₹2000 Cleartrip voucher

- ₹250 Swiggy Voucher

- Get 10% cashback for the first 90 days.

- No Joining and Annual Fees

- 10% Cashback up to ₹2,000 in the first 90 days of issuance

- Get a movie ticket voucher worth ₹500 on spending over ₹50,000 in a calendar month. Maximum of ₹3000 per cardholder in a year

- BookMyShow Saturday Buy one get one free movie tickets Up to ₹250

- 2 Reward points for every ₹150 spent

- 3X Rewards on Dining, Hotels, and Telecom for the first 12 months from the date of issuance

- 5 Times (5X) Rewards on subsequent purchases made upon spending ₹400,000 in a year, up to ₹1,000,000.

- Fuel Surcharge Waiver

- Redeem Air Miles on Jet Airways and Singapore Airlines

- Discounts on Movies, Flights, Restaurants and more

- Get 6 points on Online, Dining & Telecom

- Get 1 point on others

- No Joining Fee. Annual fee of ₹499 (Waived off on annual spends of ₹50000 or more). Amazon voucher worth ₹500 on payment of the annual fee.

- 10% Cashback up to ₹1000 in the first 60 days of issuance

- 3X Rewards on Online, Dining & Telecom spends

- Attractive Instalment plans at 10.99% per annum for EMI products booked within the first 90 days of card issuance

- Get a movie ticket voucher worth ₹200 on spending over ₹15,000 in a calendar month. Maximum of ₹1200 per cardholder in a year

- Fuel Surcharge Waiver

- 2 Reward points for every ₹100 spent

- Movie ticket voucher worth ₹1,000 on spending over ₹75,000 in a calendar month. Maximum of ₹6,000 per cardholder in a year

- 50% cashback at PVR Cinemas on purchase of movie tickets, upto ₹500 cashback per month

- 2 Reward points for every ₹100 spent

- No Joining and Annual Fees

- Movie ticket voucher worth ₹1,000 on spending over ₹75,000 in a calendar month. Maximum of ₹6,000 per cardholder in a year

- 50% cashback at PVR Cinemas on purchase of movie tickets, upto ₹500 cashback per month

- Fuel surcharge waiver

- Online fraud protection and lost card liability

- Air miles conversion on InterMiles, British Airways and Singapore Airlines

- Discounted green fees and dedicated 24-hour golf concierge service

- Airport lounge access

- Get 4 points online

- Get 2 points on others

- 2 Reward Points on ₹150 spent. 2 X Reward Points on online spends.

- Redeem Reward points as CashBack on your MoneyBack Credit Card (100 Reward Points = ₹20)

- Zero Lost Card liability post reporting of the loss of card

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to ₹50 Lakhs*

- Free Fire and Burglary protection for goods above ₹5000 for 180 days

- Spend Milestone Offer

- Spend ₹50,000 in a Quarter and get ₹500 E-Voucher

- Get discount on movie ₹4,000 or more in a year

- Get a discount on dining ₹9,600 or more in a year

- Save ₹600 on Fuel Surcharge waiver in a year

- Get started on an entertaining journey with a range of gift vouchers for shopping, apparel, dining, and many more categories

- 25% off on movies and up to 20% off on dining. (at participating outlets).

- Earn Bouquet of discount vouchers as Welcome Bonus

- 3 Reward Points (RP) on Rs. 150 spent. 10 RP on dining spends on weekdays (Mon-Fri).

- Get movie discounts of Rs. 4,000 or more in a year!

- Earn big discounts of Rs. 9,600 or more every year on dining!

- Save Rs. 600 in a year on your fuel transactions

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to 50 Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days

- Earn 50 reward points on selected partners

- Earn 5 reward points on all other spent

- Complimentary Annual Memberships of Zomato Gold, Amazon Prime and more

- Air accident cover of ₹2 Crore.

- Emergency Medical Expenses Cover of up to ₹50 Lakh

- Credit Liability Cover Of up to ₹9 Lakh

- Travel Insurance Cover of up to ₹55,000 on baggage delay (Capped to 10$ per hour restricted to 8 hours)

- Complimentary annual memberships can be availed upon achieving annual spend milestone of Rs 8 Lakhs at the time of Card Anniversary (Card anniversary is 12 months from card open month).

- Spend ₹5L in 12 Months and get Renewal Fee waived for next renewal year.

- 6 Complimentary Golf games (Green fee waiver) per quarter around 20 golf courses in India and 40 golf courses world over.

- Earn 4 reward points on every ₹150 you spend

- Welcome Benefit of 2,500 Reward Points upon fee realization

- Complimentary Airport Lounge Access through Priority Pass Membership

- Lowest Foreign Currency Mark-up Fee of 2% on international transactions

- Now get 15,000 bonus points every year on spends of Rs.8 Lac

- Use your card* to make quick transactions at merchant locations accepting contactless cards

- Earn 4 Reward Points on every Rs. 150 spent and redeem rewards against exclusive lifestyle options

- Earn 2 Points for every ₹150 you spend

- Weekday Dining Bonanza – Earn 5 Points* on every ₹150 spent on Weekday Dinings.

- Get movie discounts of ₹4,000 or more in a year!

- Earn big discounts of ₹9,600 or more every year on dining!

- Save ₹600 in a year on your fuel transactions

- Get started on an entertaining journey with a bouquet of Gift Vouchers, across Shopping, Apparel, Dining and many more categories.

- 25% off on movies and up to 15% off on dining. (at participating outlets)

- Bouquet of discount vouchers as welcome gift

- 2 Reward Points on ₹150 spent. 5 RP on dining spends on weekdays (Mon-Fri)

- Get movie discounts of ₹4,000 or more in a year!

- Earn big discounts of ₹7,500 or more every year on dining!

- Save ₹300 in a year on your fuel transactions

-

Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to ₹50 Lakhs*

- Free Fire and Burglary protection for goods above ₹5000 for 180 days

- 10,000 Miles within 60 days on your first spend of ₹1,000

- 3,000 Miles on Card renewal.

- Up to 15% savings across participating restaurants

- Easy EMI options at more than 2,000 outlets

- Air Accident Insurance Cover up to ₹1 Crore.

- Lost Card Liability Cover of ₹10 Lakh.

- Get benefits worth ₹19,000 in the first year

- Welcome miles worth ₹4500

- Miles worth ₹3200 on airlines spends

- Additional miles worth ₹11,600 on travel and other spends

- Complimentary domestic airport lounge access

- Instantly Pay with Points at select partners

- Simply tap and pay using a contactless card

- Never expiring miles

- Cashback value per point - 0.45 paise. Benefits rounded down to nearest fifty

- Up to 15% savings across participating restaurants

- Easy EMI options at more than 2,000 outlets

-

Get benefits worth Rs 3,300+ in the first year

- Rs 2400^ on movies, telephone & utility bills

- 950** on other spends

- Instantly Pay with Points at select partners

- Simply tap and pay using a contactless card

- 1,500 on your first spend within 30 days of card issue.

- 1,000 on your first spend of Rs.1000 within 60 days of card issue.

- Up to 15% savings across participating restaurants

- Easy EMI options at more than 2,000 outlets

-

Get benefits worth Rs 4800+ in first year

- Fee waiver of Rs 1000 on annual spends of Rs 30000

- Points worth Rs 850^ on card activation

- Additional points worth Rs 2950**

- Never - expiring reward points

- Instantly Pay with Points at select partners

- Simply tap and pay using a contactless card

- Earn 4 Turbo points at IndianOil outlets

- 2 Turbo Points at grocery and supermarkets; 1 Turbo Point on all other spent

- Fee waiver of Rs 1000 on annual spends of Rs 30000

- Never - expiring reward points

- ₹250 Turbo Points on your first spend within 30 days of card issuance.

-

Get up to 71 liters of free fuel in the first year

- Fee waiver of ₹1,000 on annual spends of ₹30,000

- Turbo points worth ₹250 on card activation

- Additional points worth ₹3,650**

- Never - expiring reward points

- Instantly Pay with Points at select partners

- Simply tap and pay using a contactless card

- 2 reward points on all

- 20 reward points on snapdeal purchases through SmartBUY

- Flat 5% Instant Discount when you shop at Snapdeal

- Free Accidental Death Insurance up to 50 Lakhs

- Snapdeal Vouchers worth Rs. 2000

- Earn 500 Reward Points

- 2 Reward Points per Rs. 150 spent on all purchases

- Flat 5% Instant Discount when you shop at Snapdeal

- Earn 20 Reward Points when you shop at Snapdeal and purchases through SmartBUY

- A fuel surcharge of 2.5% plus service tax will be replaced by Convenience fee of 1%

- Avail up to 50 days of interest-free period from the date of purchase

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to 50 Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days

- 3 reward points on all

- 4.5 reward points on dining

- Spend over 5 lac on your card and earn an Air voucher worth Rs. 8,000.

- Free Accidental Death Insurance up to 50 Lakhs

- 2.5% plus service tax will be replaced by Convenience fee of 1%

- 3 Reward Points on every Rs 150 spent.

- Get 50% more points on dining spend.

- Spend over 5 lac on your card and earn an Air voucher worth Rs. 8,000.

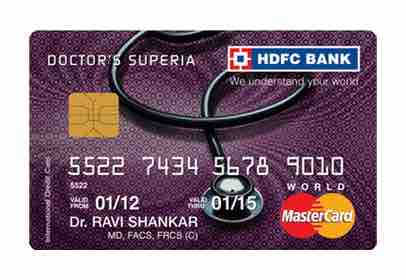

- Get the first-year fee reversed if you spend Rs. 15,000 in the first 90 days of card setup date and renewal fee reversed if you spend Rs. 1,00,000 in a year prior to the renewal date

- Doctor’s Superia Travel Club

- 1) International Miles - Enjoy redemption of Reward Points at over 20 international airlines through KrisFlyer - Singapore Airlines Frequent Flyer Program.

- Enjoy redemption of Reward Points against air miles on Jet Airways

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to 50 Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days*

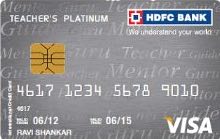

- 2 reward points on all

- 6 reward points on weekend shoppings

- 500 Bonus Reward Points on Teacher's Day

- Free Accidental Death Insurance up to 50 Lakhs

- 2.5% plus service tax will be replaced by Convenience fee of 1%

- 2 Reward Points per Rs. 150 spent on all purchases

- Earn 6 Reward Points on weekend shopping

- 500 Bonus Reward Points on Teacher's Day

- A fuel surcharge of 2.5% plus service tax will be replaced by Convenience fee of 1%

- Avail up to 50 days of the interest-free period from the date of purchase

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to 50 Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days

- 3 reward points on all

- 50% more reward points on dining and grocery

- ₹1000 Shopping vouchers on ₹75,000 spends every 6 months

- Free Accidental Death Insurance upto 50 Lakhs

- Earn 1000 Reward Points.

- 3 Reward Points per Rs. 150 spent on all purchases

- 50% more Reward Points on dining and grocery spends

- Get Rs. 1,000 Shopping vouchers on Rs. 75,000 spends every 6 months.

- A fuel surcharge of 2.5% plus service tax will be replaced by Convenience fee of 1%

- Avail up to 50 days of the interest-free period from the date of purchase

- Redeem Reward Points as Cash Back against outstanding amount on your Credit Card (100 Reward Points = Rs. 20)

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to 50 Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days

- Earn 4 Reward Points for every ₹150

- 6 Complimentary access to 700+ Lounges Worldwide

- Air accident cover of INR 1 Crore

- Earn 1000 Reward Points.

- Earn 4 Reward Points for every Rs. 150/- spent

- 1 Reward Point = 1 Air Mile; 1 Reward Point = 0.50

- Get Up to 6 Complimentary access to 700+ Lounges Worldwide in a calendar year

- Embark on a delectable journey where you can enjoy a 15% discount

- Air accident cover of INR 1 Crore.

- Emergency Medical Expenses Cover of up to INR 25 Lakh

- Credit Liability Cover Of up to INR 9 Lakh

- Welcome Benefit of 1000 Reward Points and Renewal Benefit of 1000 Reward Points

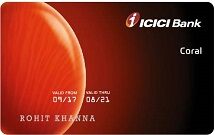

- 2 PAYBACK points on all(except fuel)

- 1 PAYBACK point on utilities and insurance categories

- 10,000 PAYBACK Points from ICICI Bank Rewards every anniversary year

- Earn up to 10,000 PAYBACK Points from ICICI Bank Rewards every anniversary year.

- One complimentary domestic airport lounge visit per quarter.

- Get the all-new feature of one complimentary domestic railway lounge visit per quarter.

- 2 complimentary movie tickets every month under the Buy One Get One free offer through www.bookmyshow.com or www.inoxmovies.com

- Minimum 15% savings on dining bills at over 2500+ restaurants across India through our Culinary Treats Programme.

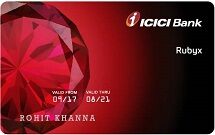

- 3 PAYBACK points on all(except fuel)

- 6 PAYBACK point on International spends

- 2 complimentary movie tickets every month under the Buy One Get One Free offer

- 15% savings on dining bills at over 2500+ restaurants

- Vouchers on Shopping and Travel worth Rs 5000

- 15,000 PAYBACK Points every anniversary year

- Get Welcome Vouchers on Shopping and Travel worth Rs 5000 on payment of joining fee.

- Earn up to 15,000 PAYBACK Points every anniversary year.

- Get up to 2 complimentary rounds of golf every month at the golf course of your choice based on eligible spends on your card.

- 2 complimentary domestic airport lounge visits per quarter, courtesy of Mastercard and American Express.

- Get the all-new feature of 2 complimentary domestic railway lounge visits per quarter, courtesy Mastercard and American

- 2 complimentary movie tickets every month under the Buy 1 Get 1 offer through www.bookmyshow.com on first come first serve basis.

- Earn 2X Points on all international transactions on your card.

- Minimum 15% savings on dining bills at over 2,500+ restaurants across India through Culinary Treats Programme

- 3 PAYBACK points on all(except fuel)

- 6 PAYBACK point on International spends

- 2 complimentary movie tickets every month under the Buy One Get One Free offer

- 2 complimentary international airport lounge visits per the calendar year

- Welcome vouchers worth ₹ 10,000

- Get Welcome Vouchers on Shopping and Travel worth Rs 10,000 on payment of joining fee.

- Get up to 20,000 PAYBACK points every anniversary year.

- 4 complimentary domestic airport lounge visits per quarter, courtesy of Mastercard and American Express.

- 2 complimentary international airport lounge visits per the calendar year and 2 complimentary domestic airport spa visit per the calendar year, under complimentary membership to Dreamfolks DragonPass Lounge Access Programme.

- Enjoy up to 4 complimentary rounds of golf every month at the golf course of your choice based on eligible spends on your card.

- Buy one movie/event ticket and get up to Rs 500 off on the second ticket, twice every month, through www.bookmyshow.com

- Minimum 15% savings on dining bills at over 2,500+ restaurants across India through Culinary Treats Programme

- 4 PAYBACK points on all(except fuel)

- 1 PAYBACK point on utilities and insurance categories

- Annual benefits estimated to be around ₹3,00,000

- Buy one ticket and get up to ₹750 off on the second ticket, up to four times every month through BookMyShow

- The offer is valid on all movie and non-movie tickets booked through BookMyShow

- Perfect your swing with exclusive access and privileges at the most iconic golfing greens in India and around the world, with a complimentary round/lesson of golf on every ₹50,000 or more spent on the card in the previous calendar month, up to a maximum of 4 rounds/ lessons of golf every month.

- Enjoy a meal with your loved ones on your birthday with a dining voucher worth ₹7,500 from Trident Hotels, valid for redemption on the full menu at any Trident Hotel near you. This offer is valid only on American Express

- Get a complimentary Gift Voucher worth ₹5,000 from Da Milano on spending ₹2,00,000 on your card in the first two months of joining. This offer is valid only on American Express

- Exclusive discounts at VLCC, Kaya Skin Clinic, Richfeel, True Fitt n Hill and Gold’s Gym

- Air accident insurance of Rs. 3 crore

- Lost baggage insurance of USD 1200

- Loss of travel document insurance of USD 500

- Lost card liability of Rs 50,000

- 2 PAYBACK points on all(except fuel)

- 1 PAYBACK point on utilities and insurance categories

- 1% fuel surcharge waiver

- Minimum 15% savings on dining at over 800 restaurants

- Built-in contactless technology to make quick and secure payments at retail outlets

- Security of a chip card to protect you against the risk of fraud.

- PAYBACK Points, redeemable for exciting gifts and vouchers.

- Fuel surcharge waiver.

- Minimum 15% savings on dining at over 800 restaurants courtesy our Culinary Treats program.

- flight bookings on MakeMyTrip get ₹2 Mycash

- holiday bookings on MakeMyTrip get ₹4 Mycash

- Spend ₹5 lakh and earn ₹4,000 Mycash on the anniversary

- 2 complimentary movie tickets every month under the Buy One Get One Free offer

- ₹2,500 Lemon Tree Hotels voucher

- ₹1,500 Mycash plus MMTDOUBLEBLACK and MMTBLACK enrolment

- Get Rs 1,500 My Cash plus MMTDOUBLEBLACK and MMTBLACK enrolment, plus Lemon Tree Hotels voucher worth Rs 2,500 on joining.

- Enjoy benefits worth up to Rs 70,000

- Get every sixth ride complimentary with Ola and a complimentary Airtel international roaming pack.

- Enjoy complimentary international and domestic airport lounge access and domestic railway lounge access.

- flight bookings on MakeMyTrip get ₹2 Mycash

- holiday bookings on MakeMyTrip get ₹3 Mycash

- 2 complimentary movie tickets every month under the Buy One Get One Free offer

- Spend ₹2.5 lakh and earn ₹1,000 Mycash on the anniversary

- ₹2,000 Lemon Tree Hotels voucher

- ₹500 Mycash plus a complimentary voucher for MMTBLACK membership

- Rs 500 My Cash plus a complimentary voucher for MMTBLACK membership plus Lemon Tree Hotels voucher worth Rs 2000 on joining.

- Enjoy benefits worth up to Rs 20,000

- Enjoy complimentary domestic airport and domestic railway lounge access.

- Annual savings of up to Rs 6,000 with the BookMyShow Buy 1 Get 1 offer, on first-come, first-serve basis.

- Domestic spends outside MakeMyTrip get Mycash ₹1.00 per ₹200

- International spends outside MakeMyTrip get Mycash ₹1.25 per ₹200

- Spends on flight bookings on MakeMyTrip get Mycash ₹2.00 per ₹200

- Spends on hotel/ holiday bookings on MakeMyTrip get Mycash ₹3.00 per ₹200

- Get 5 points on Grocery, Departmental stores & Movies

- Get 1 points on others

- Zero fuel surcharge

- 0.5% cashback on card bill payment

- Get free Personal Accidental Death Cover to ensure financial protection of your family

- 1 Reward points for every ₹100 spent

- 5X rewards on Grocery, Departmental stores, Movies for every ₹100 spent

- 0.5% cashback on card bill payment

- 1% fuel surcharge waived for all transactions between ₹400 - ₹5,000

- Spend ₹6,000 within 60 days and ₹35,000 in a year for reversal/waiver of annual fees

- Get 5 points on Dining, Utility bills, Online shopping

- Get 1 points on others

- Zero fuel surcharge

- 1,000 bonus rewards points every month

- Get free Personal Accidental Death Cover to ensure financial protection of your family

- 1 Reward points for every ₹100 spent

- 5X rewards on Dining, Utility bills, Online shopping for every ₹100 spent

- 1,000 bonus rewards points every month

- 1% fuel surcharge waived for all transactions between ₹400 - ₹5,000

- Spend 7,500 within 60 days and 70,000 in a year, for reversal/waiver of annual fees

- 5X Rewards are capped at 1,000 Reward Points on the mentioned categories per month. Further spends in that month on these categories will earn Reward Points at the regular earn rate

- Get 10 rewards on travel, dining and abroad

- Get 2 points on others

- Zero fuel surcharge

- Complimentary airport lounge, 24x7 concierge, Golf program

- Get free Personal Accidental Death Cover to ensure financial protection of your family

- 2 Reward points for every ₹100 spent

- 10 rewards on travel, dining and abroad for every ₹100 spent

- Complimentary airport lounge, 24x7 concierge, Golf program

- 5X Rewards are capped at 2,000 Reward Points on the mentioned categories per month. Further spends in that month on these categories will earn Reward Points at the regular earn rate

- 6 PAYBACK Points on fuel at HPCL pumps

- Get 2 PAYBACK on others

- Enjoy ₹100 discount on up to 2 movie tickets per month at www.bookmyshow.com

- Minimum 15% savings on dining at over 800 restaurants courtesy our Culinary Treats program

- Get 2.5% cashback* and savings of 1% fuel surcharge* on fuel purchases at HPCL pumps

- Earn 3X or 6 PAYBACK Points per ₹100 spent on fuel at HPCL pumps

- Redeem 2,000 PAYBACK Points for fuel worth ₹500

- Get 2.5% cashback* and savings of 1% fuel surcharge* on fuel purchases at HPCL pumps

- Enjoy ₹100 discount on up to 2 movie tickets per month at www.bookmyshow.com

- Minimum 15% savings on dining at over 800 restaurants courtesy our Culinary Treats program

- Enrich your travel experience with complimentary access to select lounges at airports in India with your ICICI Bank HPCL Coral American Express® Credit Card. To avail, please present your Card at the lounge reception

- Get 2 PAYBACK points

- ₹100 off on movie tickets

- Minimum 15% savings on dining

- Reduce fuel bills with 2.5% Cashback

- Save on 1% fuel surcharge

- Reduce fuel bills with 2.5% Cashback

- Save on 1% fuel surcharge

- Get ₹100 off on movie tickets any day of the week, through www.bookmyshow.com. You can avail this discount twice each month or save ₹2,400 each year!

- Minimum 15% savings on dining at over 800 leading restaurants across cities in India.

- Earn 2 PAYBACK Points on every ₹100 spent on retail purchases except fuel.

- Redeem your PAYBACK Points from movie and travel vouchers to lifestyle products, mobiles, appliances and more.

- Spend ₹50,000 or more annually on your Card and we will reverse your Annual Fee (₹199) for that year.

- Make 5 transactions each month on your ICICI Bank American Express Credit Card and get a bookmyshow e-voucher worth Rs.400

- Get 2 PAYBACK on every purchase except fuel

- Enjoy ₹100 discount on up to 2 movie tickets per month at www.bookmyshow.com

- Minimum 15% savings on dining at over 800 restaurants courtesy our Culinary Treats program

- Get 2.5% cashback* and savings of 1% fuel surcharge* on fuel purchases at HPCL pumps

- Earn 2 PAYBACK Points per ₹100 spent on retail purchases except fuel

- Redeem 2,000 PAYBACK Points for fuel worth ₹500

- Get 2.5% cashback* and savings of 1% fuel surcharge* on fuel purchases at HPCL pumps

- Enjoy ₹100 discount on up to 2 movie tickets per month at www.bookmyshow.com

- Minimum 15% savings on dining at over 800 restaurants courtesy our Culinary Treats program

- Get 2 PAYBACK on every purchase except fuel

- 2 complimentary movie tickets every month under the Buy One Get One free offer

- 15% savings on dining bills at over 2500+ participating restaurants across India

- complimentary Scuderia Ferrari watch

- Earn 2 PAYBACK Points on every ₹100 spent for all retail purchases except fuel.

- Complimentary Scuderia Ferrari watch on joining

- Opportunity to attend an official Ferrari Challenge race*

- Visit to the Ferrari Museum and Factory in Maranello, Italy*

- Attend an event with special Ferrari VIP guests in Maranello, Italy*

- Discounts on Ferrari merchandise at the Online Ferrari Store upon registering at http://f1member.ferrari.com/ **

- 15% discount on entry tickets to Ferrari World Abu Dhabi for tickets bought at the park counter

- Complimentary Access to domestic airport lounges in India

- Buy One Get One offer on www.bookmyshow.com, Get up to 2 free tickets per month valued up to ₹ 300 per ticket

- Buy 1, Get 1 offer at INOX Cinemas, Get up to 2 free tickets per month valued up to ₹ 300 per ticket

- 15% savings on dining bills at over 2500+ participating restaurants across India through Culinary Treats Programme

- Save 1% on fuel surcharge

- Up to 20% discount on Ferrari merchandise at the Ferrari Store in Maranello, Italy

- Up to 15% discount on Ferrari merchandise at the Online Ferrari Store upon registering at http://f1member.ferrari.com

- Get 2 PAYBACK on every purchase except fuel

- 2 complimentary movie tickets every month under the Buy One Get One free offer

- 15% savings on dining bills at over 800 restaurants across India

- Save on 1% fuel surcharge

- 1 complimentary domestic Airport Lounge visit per quarter

- 2 complimentary movie tickets every month under the Buy 1, Get 1 offer from BookMyShow

- Buy 1, Get 1 offer at INOX Cinemas

- 15% savings on dining bills at over 800 restaurants across India through the Culinary Treats Programme

- Save 1% on fuel surcharge

- 15% discount on entry tickets to Ferrari World Abu Dhabi for tickets bought at the park counter

- Up to 20% discount on Ferrari merchandise at the Ferrari Store in Maranello, Italy

- Up to 15% discount on Ferrari merchandise at the Online Ferrari Store upon registering at http://f1member.ferrari.com

- Get 5% cashback at supermarkets

- Get 3x rewards when you use your credit card for all other expenses

- Get INR 2,000* BookMyShow vouchers on your first transaction in first 90 days

- Get Rs. 500 off at exclusive Croma stores across India with your Visa Card

- 5% cashback at supermarkets

- Get 3x rewards when you use your credit card for all other expenses.

- Get INR 2,000* BookMyShow vouchers on your first transaction in first 90 days with your Manhattan Platinum credit card

- Get Rs. 500 off at exclusive Croma stores across India with your Visa Card

- Enjoy a host of discounts and offers across dining, shopping, travel and many more with the Standard Chartered Good Life programme

- Enjoy a host of offers and discounts across shopping, travel, dining and more with exclusive offers on your credit card.

- 5% cashback on fuel

- 5% cashback on telephone bills

- 5% cashback on utility bills

- Get 1 reward point

- Save up to Rs 6,000 p.a. monthly expenses with Super Value Titanium credit card.

- 5% cashback on fuel maximum of INR 200 per month

- 5% cashback on telephone bills maximum of INR 200 per month

- 5% cashback on utility bills maximum of INR 100 per month

- Get 1 reward point for every INR 150 when you use your credit card for all other expenses.

- Enjoy a host of discounts and offers across dining, shopping, travel and many more with the Standard Chartered Good Life programme

- Get 5 reward points

- 1 reward point equal to Re 1

- Enjoy up to INR 10,000 cash back* on MakeMyTrip

- Up to 25% discount* at top 250 restaurants in India with advance reservation via concierge

- Enjoy up to INR 10,000 cash back* on MakeMyTrip. Just book your tickets within 90 days of card issuance and get the cash back on a single transaction

- Earn 5 reward points on every INR 150 spent and get maximum benefit with 1 reward point equal to Re 1

- 5% cashback* on duty free spends

- access to over 1000 airport lounges across the world

- Access 20 premier golf courses in India and 150 worldwide

- Up to 25% discount* at top 250 restaurants in India with advance reservation via concierge & online booking

- Get 9 reward points

- Get vouchers worth INR 2,800

- Get 5% cashback on your grocery shopping at SPAR stores

- Earn up to 9x reward points for every INR 200 spent on Landmark stores such as Lifestyle, Max and Home Centre.

- Get 5% cashback on your grocery shopping at SPAR stores

- Get vouchers worth INR 2,800

- Earn 6 Skyward miles on Emirates transactions

- Earn 3 Skyward miles on all others

- Welcomed with 4,000 bonus Miles

- Get 5% cashback on duty free shopping

- Get your new card and be welcomed with 4,000 bonus Miles

- Earn 6 Skyward miles on every INR 150 spent on Emirates transactions and 3 Skyward Miles on every INR 150 spent on all other transactions.

- Get 5% cashback on duty free shopping, upto a maximum of INR 1,000 per month.

- Get complimentary lounge access to 25+ domestic lounges through the Mastercard Lounge program and 2 complimentary accesses to Domestic and International Priority Pass lounges per month

- Protect yourself with complimentary overseas air accident coverage of INR 1 Crore including insurance on loss of baggage and flight delay.

- Tee off in style. Get access to three complimentary golf games a year, one free lesson a month and 50% discount on all games

- Earn 4 reward points on Yatra

- Earn 2 reward points on all others

- Welcome gift worth INR 4,000

- Earn 10% cash back on travel bookings made through yatra.com

- Earn 10% cash back on travel bookings made through yatra.com

- Earn 4x reward points on every INR 100 spent on yatra.com

- Earn double the reward points on INR 100 for all other expenditures.

- welcome gift of travel vouchers worth INR 4,000 from yatra.com within 60 days of card setup.

- Changed your travel plans? Get waivers on Yatra cancellation fees for all tickets booked on yatra.com

- Earn fuel surchange waiver of 1% on all fuel expenditures

- Enjoy a host of discounts and offers across dining, shopping, travel and more with the Standard Chartered Good Life programme

- Earn 10 reward points on Dining, Movies, and Grocery

- Earn 1 reward points on all others

- Spend 2,000 or more in first 60 days and get 2,000 bonus Reward Points

- Get freedom from paying the 1% fuel surcharge at any petrol pump

- 10x Reward Points per ₹100 spent on Dining, Movies, Departmental Stores and Grocery Spends.

- On all your other spends, earn 1 Reward Point per ₹100 spent

- 4 Reward Points = ₹1

- Get freedom from paying the 1% fuel surcharge at any petrol pump

- 1st Year Fee ₹499

- 2nd Year onwards ₹499. Waived on annual spends > 1 lakh in previous year

- Earn 10 reward points on online spends with exclusive partners

- Earn 5 reward points on all other online spends

- Get Amazon.in gift card worth Rs.500* on joining

- Apply online and get BookMyShow voucher worth ₹250

- Get freedom from paying the 1% fuel surcharge at any petrol pump

- 10x Reward Points on online spends with exclusive partners - Amazon / BookMyShow / Cleartrip / Lenskart / Netmeds / Rentomojo / UrbanClap

- Earn 5X rewards on all other online spends

- Get Amazon.in gift card worth Rs.500* on joining

- Apply online and get BookMyShow voucher worth ₹250

- Get freedom from paying the 1% fuel surcharge at any petrol pump

- 1st Year Fee ₹499

- 2nd Year onwards ₹499. Waived on annual spends > 1 lakh in previous year

- Earn 20 reward points on standing instructions of Utility Bills payments

- Earn 15 reward points on BigBasket spends

- Get 10 Reward Points on Dining, Groceries and Movie

- Welcome e-gift Voucher worth ₹3,000 from any of the following brands: Bata/Hush Puppies, Pantaloons, Shoppers Stop and Yatra.com

- Apply online and get Pizza Hut Voucher worth ₹500

- Enjoy 20 Reward Points per Rs. 100 spent on your birthday

- Get 20 Reward Points per ₹100 spent on standing instructions of Utility Bills payments

- Get 15 Reward Points per ₹100 spent on BigBasket

- Get 10 Reward Points per ₹100 spent on Dining, Groceries, Departmental stores and Movies

- Welcome e-gift Voucher worth ₹3,000 from any of the following brands: Bata/Hush Puppies, Pantaloons, Shoppers Stop and Yatra.com

- Get Pizza Hut e-Voucher worth ₹1,000 on achieving spends of ₹50,000 in a calendar quarter

- Waiver of Renewal Fee on annual spends of ₹3 Lakhs

- E-Gift Voucher worth ₹7,000 from Yatra.com/Pantaloons on achieving annual spends of ₹5 Lakhs

- Enjoy complimentary Trident Privilege Red Tier Membership - Get exclusive 1,000 Welcome Points on registration

- Enjoy 1,500 Bonus Points on your first stay & additional Rs. 1,000 hotel credit on extended night stay

- Enjoy 20 Reward Points per ₹100 spent on your birthday

- Apply online and get Pizza Hut voucher worth ₹500

- Enjoy Complimentary Club Vistara Silver membership - Get 1 complimentary Lounge Access Voucher and 1 Upgrade Voucher

- Earn 9 Club Vistara Points for every ₹100 spent on Vistara flights

- 4 complimentary visits per year to International Priority Pass Lounges, outside India

- 8 complimentary visits per year to Domestic VISA/Mastercard Lounges in India

- Savings of 10% off on Hertz car rental and up to 35% off on Avis Car Rentals

- 10% back on AC1, AC2, AC3, AC CC as reward points for your ticket purchase on irctc

- 5% back Air ticket purchases on www.air.irctc.co.in

- Get 1500 reward points equivalent to INR 1500 on payment of first annual fee

- Avail Movie voucher worth 500 from Book my show* on spends of INR 2000 within first 60 days

- Earn 2,500 Reward Points on annual travel spends* of ₹50,000

- Earn 5,000 Reward Points on annual travel spends* of ₹1,00,000

- Get 1500 reward points equivalent to ₹1500 on payment of first annual fee

- Avail Movie voucher worth 500 from Book my show* on spends of ₹2000 within first 60 days

- 10% back on AC1, AC2, AC3, AC CC as reward points for your ticket purchase on www.irctc.co.in

- 5% back Air ticket purchases on www.air.irctc.co.in

- 5% back E-catering purchases on www.ecatering.irctc.co.in

- Earn 2,500 Reward Points on annual travel spends* of ₹50,000

- Earn 5,000 Reward Points on annual travel spends* of ₹1,00,000

- Spend Based Reversal of Annual Fee on spends of ₹2 Lakhs

- Complimentary Rail Accident Insurance of ₹10 Lakhs

- Complimentary Air Accident insurance of ₹50 Lakhs

- Complimentary Fraud Liability cover of ₹1 Lakh

- Enjoy freedom from paying the 1% fuel surcharge across all petrol pumps in India, on transactions of ₹500 - ₹4,000, exclusive of GST and other charges

- You save 1.8% transaction charges, exclusive of GST and all other charges, when you book railway tickets on irctc.co.in

- You save 1.8% transaction charges, exclusive of GST and all other charges, when you book air tickets on air.irctc.co.in

- Get 5X Reward Points on Dining, Departmental stores and Grocery Spends

- Earn 2 Reward Points per ₹100 on all other spends, except fuel

- Welcome e- Gift Voucher worth ₹5,000

- For Pantaloons, Shoppers Stop and Hush Puppies /Bata you can redeem your e-gift voucher by showing the code at the respective brand store

- Earn upto 50,000 Bonus Reward Points worth ₹12,500/ year

- Earn 10,000 bonus Reward Points on achieving annual spends of ₹3 lakhs

- Welcome e- Gift Voucher worth ₹5,000

- For Pantaloons, Shoppers Stop and Hush Puppies /Bata you can redeem your e-gift voucher by showing the code at the respective brand store

- Free Movie Tickets worth ₹6,000 every year

- Transaction valid for at least 2 tickets per booking per month. Maximum discount is ₹250/ticket for 2 tickets only. Convenience Fee would be chargeable

- Earn upto 50,000 Bonus Reward Points worth ₹12,500/ year

- Earn 10,000 bonus Reward Points on achieving annual spends of ₹3 lakhs

- Get 5X Reward Points on Dining, Departmental stores and Grocery Spends

- Earn 2 Reward Points per ₹100 on all other spends, except fuel

- Complimentary membership to the Priority Pass Program worth $99

- Enjoy 2 complimentary Domestic Airport Lounge visits every quarter in India

- Get 1 complimentary Lounge Access Voucher and 1 Upgrade Voucher

- You are also entitled to 2 Reward Points on every ₹100 spent on International transactions.

- Get 6 Reward Points on Departmental Stores, Grocery, Dining, Movies, Entertainment and International spends

- Earn 1 Reward Point per ₹100 on all other spends

- Welcome Yatra Gift Voucher worth ₹8,250

- ₹1,000 off on domestic flight bookings. Min. trxn of ₹5,000

- ₹4,000 off on international flight bookings. Min. trxn of ₹40,000

- Welcome Yatra Gift Voucher worth ₹8,250

- Reward Points on every ₹100 spend on Departmental Stores, Grocery, Dining, Movies, Entertainment and International spends

- Get 6 Reward Points on Departmental Stores, Grocery, Dining, Movies, Entertainment and International spends

- Earn 1 Reward Point per ₹100 on all other spends

- Welcome Yatra Gift Voucher worth ₹8,250

- ₹1,000 off on domestic flight bookings. Min. trxn of ₹5,000

- ₹4,000 off on international flight bookings. Min. trxn of ₹40,000

- 20% off on domestic hotels Min. trxn of ₹3,000. Max. discount of ₹2,000

- Complimentary Air Accident cover of ₹50 lacs

- Valid for primary cardholder, when ticket is booked via Yatra.com using the Yatra SBI Card

- Enjoy freedom from paying 1% fuel surcharge across all petrol pumps in India.

- Max. surcharge waiver of ₹100 monthly

- Get 2 Reward Points for every ₹100 spend

- Welcome Get 5,000 Reward points

- Convert your Reward points into Air India miles. 1 Reward point is equal to 1 Air India Air mile

- Earn upto 15 Reward Points for every ₹100 spent on Air India tickets booked through airindia.com, airindia mobile app.

- 15 Reward Points when booked for self and 5 Reward Points when booked for others

- Get 5,000 Reward points* as a welcome gift on the payment of your joining fee

- Get 2,000 Reward points as a Anniversary gift

- Convert your Reward points into Air India miles. 1 Reward point is equal to 1 Air India Air mile

- Get 2 Reward Points for every ₹100 spend

- Earn upto 15 Reward Points for every ₹100 spent on Air India tickets booked through airindia.com, airindia mobile app.

- 15 Reward Points when booked for self and 5 Reward Points when booked for others

- Enjoy freedom from paying the 1% fuel surcharge, valid across all petrol pumps

- Earn 5X Reward Points on CSD, Dining, Movies, Departmental Stores and Grocery Spends

- Avail waiver of Renewal Fee on annual spends of Rs. 50,000 or more

- 1% Fuel Surcharge Waiver at all fuel stations across the country

- Earn 5X Reward Points on CSD, Dining, Movies, Departmental Stores and Grocery Spends

- No Joining and Annual Fees

- Earn 5X Reward Points on CSD, Dining, Movies, Departmental Stores and Grocery Spends

- Avail waiver of Renewal Fee on annual spends of ₹50,000 or more

- 1% Fuel Surcharge Waiver at all fuel stations across the country

- Earn 4 Reward Points for every ₹100 spent

- Get 20,000 Reward points* as a welcome gift on payment of your joining fee

- Enjoy International Airport Luxury Lounge Access to over 600 airport lounges with complimentary Priority Pass Program

- Get 20,000 Reward points* as a welcome gift on payment of your joining fee

- Get 4 Reward points for every ₹100 spent.

- Get up to 1,00,000 bonus Reward points annually

- Enjoy International Airport Luxury Lounge Access to over 600 airport lounges with complimentary Priority Pass Program

- Joining Fee - ₹4,999

- Convert your Reward points into Air India miles. 1 Reward point is equal to 1 Air India Air mile

- Earn upto 30 Reward Points for every ₹100 spent on Air India tickets booked through airindia.com

- 30 Reward Points when booked for self and 10 Reward Points when booked for others

- 10% back on AC1, AC2, AC3, AC CC as reward points for your ticket purchase on irctc

- Get 1 Reward point for every ₹125 spent on non-fuel retail purchases

- Get 350 activation bonus Reward Points on single transaction of ₹500 or more within 45 days of card issuance.

- Save 1.8% transaction charges on railway ticket bookings

- Enjoy freedom from paying the 1% fuel surcharge across all petrol pumps in India

- Buy tickets through irctc.co.in for AC1, AC2. AC3 and AC CC and earn upto 10% Valueback as Reward points.

- Save 1.8% transaction charges on railway ticket bookings

- Get 350 activation bonus Reward Points on single transaction of ₹500 or more within 45 days of card issuance.

- Enjoy freedom from paying the 1% fuel surcharge across all petrol pumps in India

- Get 1 Reward point for every ₹125 spent on non-fuel retail purchases

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Welcome e- Gift Voucher worth ₹1,000 from STAR

- 3.5% value back on spends at STAR Outlets

- Upto 5% value back on spends on select TATA Outlets

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Welcome e- Gift Voucher worth ₹1,000 from STAR

- 3.5% value back on spends at STAR Outlets

- Upto 5% value back on spends on select TATA Outlets

- Spend based fees reversal on spends of ₹1,00,000 & above annually

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Get 500 Empower Points worth ₹500 on total spends of ₹2,000

- Get 1.5% value back on spends at Croma

- Get up to 5% value back on spends on Tata outlets

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Get 500 Empower Points worth ₹500 on total spends of ₹2,000

- Get 1.5% value back on spends at Croma

- Get up to 5% value back on spends on Tata outlets

- Get your annual fee waived off, on spending ₹1,00,000 or more in a year

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Welcome e- Gift Voucher worth ₹3,500 from STAR

- Anniversary e- Gift Voucher worth ₹3,000 from STAR. Eligibility on crossing spends of ₹2 lakhs in the previous year

- 3.5% value back on spends at STAR Outlets

- Upto 5% value back on spends on select TATA Outlets

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- Welcome e- Gift Voucher worth ₹3,500 from STAR

- Anniversary e- Gift Voucher worth ₹3,000 from STAR. Eligibility on crossing spends of ₹2 lakhs in the previous year

- 3.5% value back on spends at STAR Outlets

- Upto 5% value back on spends on select TATA Outlets

- STAR e- Gift Vouchers worth ₹3,000 on spends of ₹4 lakhs and ₹5 lakhs each

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- e- Gift Voucher worth ₹3,000 from any of the following brands: Yatra, Hush Puppies / Bata, Aditya Birla Fashion, Westside

- Anniversary Gift: Eligibility on crossing spends of ₹2 lakhs in the previous year

- Get 2% value back on spends at Croma

- Get up to 5% value back on spends on Tata outlets

- 3 Reward Points per ₹100 spent on departmental & grocery stores

- Get 1 Reward point for every ₹100 spent on other retail spends

- e- Gift Voucher worth ₹3,000 from any of the following brands: Yatra, Hush Puppies / Bata, Aditya Birla Fashion, Westside

- Anniversary Gift: Eligibility on crossing spends of ₹2 lakhs in the previous year

- Get 2% value back on spends at Croma

- Get up to 5% value back on spends on Tata outlets

- Get spend rewards on annual spending of ₹4 lakhs and 5 lakhs, each

- 4 miles for every ₹200 spent

- 20 Miles for every ₹200 for Spends on Movie Bookings

- Welcome bonus 5,000 award miles

- Annual bonus 3,000 award miles

- 2 Priority Pass lounge visits per year

- Welcome bonus 5,000 award miles

- Annual bonus 3,000 award miles

- Joining Fee - ₹3,500

- 4 miles for every ₹200 spent

- 20 Miles for every ₹200 for Spends on Movie Bookings

- With the Priority Pass lounge access facility, you can enjoy complimentary access to more than 600 airport lounges around the world. Priority Pass will be issued to you automatically on activation of your credit card

- 2 Priority Pass lounge visits per year

- You can avail a minimum discount of 15% at partner restaurants through the ‘Dining Delights’ program.

- Avail fuel surcharge refund of 1% when your fuel transactions range between ₹400 and ₹4,000. This is applicable to all the petrol stations across India.

- For any purchase of over ₹2,500, you get the option of converting it to EMI which you can easily off in monthly instalments.

- 6 miles for every ₹200 spent

- 20 Miles for every ₹200 for Spends on Movie Bookings

- Welcome bonus 15,000 award miles

- Annual bonus 4,000 award miles

- 4 Priority Pass lounge visits per year

- Welcome bonus 15,000 award miles

- Annual bonus 4,000 award miles

- Joining Fee - ₹10,000

- 6 miles for every ₹200 spent

- 20 Miles for every ₹200 for Spends on Movie Bookings

- With the Priority Pass lounge access facility, you can enjoy complimentary access to more than 600 airport lounges around the world. Priority Pass will be issued to you automatically on activation of your credit card

- 4 Priority Pass lounge visits per year

- You can avail a minimum discount of 15% at partner restaurants through the ‘Dining Delights’ program.

- Avail fuel surcharge refund of 1% when your fuel transactions range between ₹400 and ₹4,000. This is applicable to all the petrol stations across India.

- For any purchase of over ₹2,500, you get the option of converting it to EMI which you can easily off in monthly instalments.

- 3 Delight points for every ₹100 spent

- Welcome bonus 750* Delight points

- Complimentary Visa Airport Lounge Access

- Joining Fee - ₹0

- Earn 3 Delight points for every ₹100 spent

- Additionally you will earn a welcome gift of 750 Delight Points on first usage of the card within 30 days days or 400 Delight Points on usage between 31 to 90 days from the card issuance date. The minimum eligible transaction value for the welcome gift is 1,500.

- Enjoy interest free credit of up to 48 days* on your purchases and manage your payments as per your convenience

- Waiver of 1%* fuel surcharge every time you fill fuel using IDBI Bank Royale Signature Card across all fuel stations for transactions in the range of 400 to 5000

- Air Travel Accident Insurance Cover for a value of 25 lakhs is provided.

- Complimentary Visa Airport Lounge Access.

- Zero Lost Card Liability is offered in case of theft or loss of card.

- 6 Delight points for every ₹100 spent on travel

- Get 3 Delight points on others

- Welcome bonus 4000 Delight points

- Complimentary Visa Airport Lounge Access

- Earn 6 Delight Points for every ₹100 you spend on travel related expenses viz. Hotels, Airlines, IRCTC, Bus Bookings etc. or earn 3 Delight Points on every other spent

- Additionally you will earn a welcome gift of 4000 Delight Points on your first transaction of minimum 1500 within 60 days of receiving your card.

- Enjoy interest free credit of up to 48 days* on your purchases and manage your payments as per your convenience

- Waiver of 1%* fuel surcharge every time you fill fuel using IDBI Bank Royale Signature Card across all fuel stations for transactions in the range of 400 to 5000

- Air Travel Accident Insurance Cover for a value of 25 lakhs is provided.

- Complimentary Visa Airport Lounge Access.

- Zero Lost Card Liability is offered in case of theft or loss of card.

- 2 Free Movie Tickets per month any day of the week on BookMyshow

- Convert Delight Points into cashback

- Double Delight Points in your birthday month!

- 4 CV points for every ₹200 spent

- During the first 3 months of card membership, transactions amounting to ₹75,000 earn 3,000 CV points

- Upto 3 Premium Economy tickets

- 4 CV points on every ₹200 spent

- Upto 3 Premium Economy tickets and 3,000 CV points on milestone spends*

- Complimentary Club Vistara Silver Membership

- Exclusive offers with Axis Bank Extraordinary weekends

- Delectable discounts with Axis Bank Dining Delights

- Annual Fee: ₹3,000

- One can receive up to at least 15% discount at restaurants which are tied to the Axis Bank Dining Delights.

- During the first 3 months of card membership, transactions amounting to ₹75,000 earn 3,000 CV points. A complimentary Premium Economy air ticket is awarded for transactions that exceed ₹1,50,000, ₹3,00,000 and ₹4,50,000.

- 6 CV points for every ₹200 spent

- Welcome aboard with a complimentary Business Class ticket

- Upto 3 Business class tickets

- Welcome aboard with a complimentary Business Class ticket

- 6 CV points on every ₹200 spent

- Upto 3 Business class tickets and 10,000 CV points on milestone spends

- Complimentary Club Vistara Gold Membership

- Exclusive offers with Axis Bank Extraordinary weekends

- Delectable discounts with Axis Bank Dining Delights

- Annual Fee: ₹10,000

- One can receive up to at least 15% discount at restaurants which are tied to the Axis Bank Dining Delights.

- A complimentary Business class ticket is awarded for transactions that exceed ₹2.5 lakhs, ₹5 lakhs and ₹7.5 lakhs

- 2 CV points for every ₹200 spent

- 1,000 Club Vistara points as activation benefit

- Up to 2 economy class tickets

- 1,000 Club Vistara points as activation benefit

- 2 CV points on every ₹200 spent

- 2 economy class tickets on milestone spends

- Complimentary Club Vistara Membership

- Exclusive offers with Axis Bank Extraordinary weekends

- Delectable discounts with Axis Bank Dining Delights

- Annual Fee: ₹1,500

- One can receive up to at least 15% discount at restaurants which are tied to the Axis Bank Dining Delights.

- Spend ₹50,000 within the first 90 days from the date of issuance of your card and get 1,000 CV Points.

- Spends of ₹1.25 lakhs earn you 1 economy ticket and spends of ₹2.5 lakhs and more earn you 1 economy ticket as well.

- 4 points for every ₹200 spent.

- 20 points on shopping during weekends for every ₹200 spent

- 40 points on dining during weekends for every ₹200 spent.

- 100 points

- Movie ticket booking made using the My Zone Credit Card will make you eligible for a 25% discount on the total booking account

- Movie ticket booking made using the My Zone Credit Card will make you eligible for a 25% discount on the total booking account.

- Any purchase above ₹2,500 made using the card can be converted into easy monthly instalments by contacting the bank.

- Axis My Zone Credit Card users can enjoy 4 complimentary visits per year to participating airport lounges within India.

- MY ZONE customers will earn 1000 bonus EDGE REWARD points on spending min ₹30,000 per calendar quarter.

- 4 points for every ₹200 spent.

- 20 points on shopping during weekends for every ₹200 spent.

- 40 points on dining during weekends for every ₹200 spent.

- Under Axis Banks Dining Delights programme, you enjoy a minimum 15% off on dining bills at select restaurants in the country.

- My Zone credit cardholders can avail up to ₹1,000 off on Myntra. One has to use coupon code MYZONE1000 at the time of checkout.

- 100 points will be credited when the card is used for online shopping for the first time

- 1st Year fee Waived on spending ₹5,000 within 45 days

- 2 points for every ₹200 spent.

- Jabong gift voucher worth 500

- BookMyShow voucher worth 300

- Amazon Voucher worth 250

- 10% off on movies, recharges and online shopping

- 2 points for every ₹200 spent.

- Jabong gift voucher worth 500

- BookMyShow voucher worth 300

- Amazon Voucher worth 250

- Any purchase amounting to ₹2,500 or higher can be converted into monthly instalments.

- You can enjoy up to 15% off on dining bills at partner restaurants located across India.

- Neo credit card offers 10% discount on Myntra, BookMyShow, Freecharge and redBus.

- Movie ticket bookings on BookMyShow gives you a discount of 10%, with monthly benefits up to Rs.50.

- The redemption value of 1 reward point is ₹0.20

- 10 points for every ₹200 spent.

- The Axis Bank Privilege Cedit Card comes with an activation benefit of Yatra voucher worth ₹5,000

- On spending ₹2.5 Lakh in a year, the cardholder can get Yatra vouchers worth double the eDGE reward points accumulated

- The Axis Bank Privilege Cedit Card comes with an activation benefit of Yatra voucher worth ₹5,000 and 8 complimentary lounge access at selected domestic airports

- On spending ₹2.5 Lakh in a year, the cardholder can get Yatra vouchers worth double the eDGE reward points accumulated.

- 10 Points on every ₹200 spend

- Convert your Credit Card purchase of ₹2,500 or more into EMI

- 1% Fuel Surcharge Waiver on monthly fuel spends

- Up to 20% discount on select restaurants which come with the Dining Delights scheme.

- Every instance of card renewal would give you up to 3,000 eDGE reward points

- 2.5% fuel surcharge waiver, for a minimum transaction amount of ₹400 and a maximum of ₹4000. Maximum benefits upto ₹400 per month

- The card also offers air accident cover of up to Rs. 2.5 Crore. Purchase protection covers and credit shield cover of 1 Lakh each are also offered to the user.

- 12 Axis EDGE REWARDS Points on every ₹200 spent.

- 2X Axis EDGE REWARDS Points on purchases at MakeMyTrip, Yatra, and Goibibo.

- Complimentary flight to a domestic location of your choice every year(one-way upto ₹10,000).

- Enjoy 25% discount at 600+(5 star dining) fine dine restaurants across India.

- BookMyShow Buy one ticket and get up to ₹500 off on the second ticket for a maximum of 5 in a month.

- 12 Axis EDGE REWARDS Points on every ₹200 spent.

- 2X Axis EDGE REWARDS Points on purchases at MakeMyTrip, Yatra, and Goibibo.

- Avail upto 8 complimentary international lounge visits per year with the Priority Pass card.

- Unlimited domestic lounge access in India.

- 8 complimentary end-to-end VIP services at the airport.

- Complimentary flight to a domestic location of your choice every year(one-way upto ₹10,000).

- 25% discount at 600+(5 star dining) fine dine restaurants across India.

- Upto 20% discount at over 4000 restaurants across India.

- BookMyShow Buy one ticket and get up to ₹500 off on the second ticket for a maximum of 5 in a month.

- Annual fee of ₹10,000 + Taxes waived off on spend of ₹15 lakhs in preceding year.

- Credit shield ₹5 Lakhs

- Air accident cover ₹4.5 Crore

- 5% Cashback on Flipkart, Myntra, and 2GUD spends.

- 4% Cashback on MakeMyTrip, Goibibo, Uber, PVR, Curefit, and UrbanClap spends.

- 1.5% Cashback on others

- ₹3,300 worth of joining activation benefits.

- Enjoy 4 complimentary lounge visit to select airport lounges.

- 5% Cashback on Flipkart, Myntra, and 2GUD spends.

- 4% Cashback on MakeMyTrip, Goibibo, Uber, PVR, Curefit, and UrbanClap spends.

- 1.5% Cashback on others

- ₹3,300 worth of joining activation benefits.

- Enjoy 4 complimentary lounge visit to select airport lounges.

- 7% on Ola rides

- 5% on all flight bookings via Cleartrip

- Earn 1% Reward Points on all other spends

- 20% back on 6k+ restaurants on payment via Dineout.

- 1% Fuel Surcharge Waiver at fuel stations across the country.

- 7% on Ola rides (upto ₹500 a month)

- 5% on all flight bookings via Cleartrip (upto ₹5,000 domestic, ₹10,000 intl)

- 20% on all domestic hotel bookings via Cleartrip

- 20% back on 6k+ restaurants on payment via Dineout.

- 6% cashback on international hotels booked via Cleartrip

- 12% cashback on Activities booked via Cleartrip

- Earn 1% Reward Points on all other spends

- 1 Reward Point = ₹1

- Zero Annual Fee for the first year

- Second year onwards, Renewal fee of ₹499 reversed on annual spends of ₹1 Lakh

- Earn 5% back on Amazon.in for Amazon Prime customers

- Earn 3% back on Amazon.in for non-prime customers

- Earn 2% back on 100+ Amazon Pay partner merchants

- Earn 1% back on all other payments

- Save a minimum of 15% on your dining bill at participating restaurants

- 1% Fuel Surcharge Waiver at fuel stations across the country.

- Earn 5% back on Amazon.in for Amazon Prime customers

- Earn 3% back on Amazon.in for non-prime customers

- Earn 2% back on 100+ Amazon Pay partner merchants

- Earn 1% back on all other payments

- No limit to the earnings from this card

- No expiry date for your earnings

- Save a minimum of 15% on your dining bill at participating restaurants

- Earn 2.5 Membership Reward points for every ₹100 spent

- Get 3X Membership Reward points on abroad spent

- Access over 1,200 of the finest Airport Lounges globally

- Earn 1,00,000 Welcome Bonus Membership Rewards Points or get stay vouchers from Taj, SeleQtions and Vivanta Hotels worth ₹45,000

- Earn 1,00,000 Welcome Bonus Membership Rewards Points or get stay vouchers from Taj, SeleQtions and Vivanta Hotels worth ₹45,000

- Access over 1,200 of the finest Airport Lounges globally

- 50% off on suites at Oberoi Hotels and Resorts

- 25% off at Taj, SeleQtions and Vivanta Hotels

- Get 3X Membership Reward points on everything, every time you spend abroad.

- Also earn 2.5 Membership Reward points for every ₹100 spent

- Points never expire.

- Point Value 50Ps to ₹1

- Elite Tier Benefits

- Taj InnerCircle Silver Tier

- Marriott Bonvoy™ Gold Elite Status - Value: ₹20,000

- Hilton Honors Gold Status - Value: ₹10,000

- Radisson Rewards Gold Status

- Hertz Gold Plus Rewards

- Shangri-La Golden Circle’s Jade Tier Value

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Spend ₹1000 4 times a month and get 1000 Bonus points for first 5 months

- Redeem your Points from the fabulous 18 and 24 Karat Gold Collection

- Earn Welcome Gift of 4,000 Bonus Membership Rewards Points

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Spend ₹1000 4 times a month and get 1000 Bonus points for first 5 months

- Earn Welcome Gift of 4,000 Bonus Membership Rewards Points

- Joining Fee - ₹1,000

- Second Year onwards ₹4,500

- Spend ₹1.5L in 12 Months and get Renewal Fee waived for next renewal year

- Redeem your Points from the fabulous 18 and 24 Karat Gold Collection

- 18,000 MR points / 18 Karat Gold Collection

- Taj voucher worth ₹9,000

- American Express Domestic Travel e-voucher worth ₹7,000

- Amazon e-voucher worth ₹7,000

- Statement Credit worth ₹6,000

- 24,000 MR points / 24 Karat Gold Collection

- Taj voucher worth ₹14,000

- Tanishq voucher worth ₹10,000

- Statement Credit worth ₹9,000

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- 0% Convenience fee on fueling up at HPCL

- Welcome Gift of 5,000 Milestone Bonus Membership Rewards Points redeemable for Travel Vouchers worth ₹4,000

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- 0% Convenience fee on fueling up at HPCL

- Welcome Gift of 5,000 Milestone Bonus Membership Rewards Points redeemable for Travel Vouchers worth ₹4,000

- Spend ₹1.90 Lacs in a year and you can get Travel Vouchers worth more ₹7,700

- Spend ₹4 Lacs in a year and get a E-Gift Card worth ₹10,000 from Taj Group and also get Travel Vouchers worth ₹11,800

- Enjoy complimentary membership to Priority Pass, with the US$99 annual membership fee waived off

- Enjoy 4 complimentary airport lounges visits per year

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Redeem your Points from the fabulous 18 and 24 Karat Gold Collection

- Earn Welcome Gift of 4,000 Bonus Membership Rewards Points

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Earn Welcome Gift of 4,000 Bonus Membership Rewards Points

- Joining Fee - ₹1,000

- Second Year onwards ₹4,500

- Earn 5,000 Membership Rewards Points upon First Year Card Renewal

- Redeem your Points from the fabulous 18 and 24 Karat Gold Collection

- Spend ₹1000 6 times a month and get 1000 Bonus points every month

- Enjoy up to 20% off every time you dine at select restaurant partners.

- 18,000 MR points / 18 Karat Gold Collection (Spend ₹3 Lakhs)

- Taj voucher worth ₹9,000

- American Express Domestic Travel e-voucher worth ₹7,000

- Amazon e-voucher worth ₹7,000

- Statement Credit worth ₹6,000

- 24,000 MR points / 24 Karat Gold Collection (Spend ₹6 Lakhs)

- Taj voucher worth ₹14,000

- Tanishq voucher worth ₹10,000

- Statement Credit worth ₹9,000

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Spend ₹25,000 and more in a calendar month get BookMyShow Voucher worth ₹500 or Flipkart Voucher worth ₹500

- Earn Welcome Gift of 11,000 Bonus Membership Rewards Points

- Earn 2 Membership Reward points for every ₹100 spent(except for spend on Fuel, Insurance, Utilities)

- Spend ₹25,000 and more in a calendar month get BookMyShow Voucher worth ₹500 or Flipkart Voucher worth ₹500

- Earn Welcome Gift of 11,000 Bonus Membership Rewards Points

- Joining Fee - ₹5,000

- Second Year onwards ₹10,000

- Enjoy 12 complimentary visits in a year (limited to 3 visits per quarter) to American Express lounges and other domestic airport lounges across India

- Air Accident Insurance of ₹1 Crore

- 4 free Supplementary Cards and 1 Additional Card

- Earn 10X Membership Rewards Points on all your spending on Flipkart and Uber for every ₹50 spent

- Earn 5X Membership Rewards Points on Amazon, Swiggy, BookMyShow and more for every ₹50 spent

- Earn 1 Membership Reward points for every ₹50 spent(except for spend on Fuel, Insurance, Utilities)

- 0% Convenience fee on fuel purchase at HPCL for transactions less than ₹25,000

- ₹500 cashback as Welcome Gift in form of statement credit on eligible spends of ₹10,000 in the first 90 days

- Earn 10X Membership Rewards Points on all your spending on Flipkart and Uber for every ₹50 spent

- Max Cap for 10X (500 Points / merchant / month)

- Earn 5X Membership Rewards Points on Amazon, Swiggy, BookMyShow and more for every ₹50 spent

- Max Cap for 5X (250 Points / month)

- Earn 1 Membership Reward points for every ₹50 spent(except for spend on Fuel, Insurance, Utilities)

- ₹500 cashback as Welcome Gift in form of statement credit on eligible spends of ₹10,000 in the first 90 days

- Spend ₹40,000 in 12 Months and get Renewal Fee waived for next renewal year

- 0% Convenience fee on fuel purchase at HPCL for transactions less than ₹25,000

- Earn 7 First Citizen Points per ₹100 spent on private label brands at Shoppers Stop

- Earn 5 First Citizen Points per ₹100 spent on other brands at Shoppers Stop

- Earn 1 First Citizen Points per ₹100 spent on other

- Spend ₹30,000 in 12 Months and get Renewal Fee waived for next renewal year

- Welcome and First-Year benefits worth ₹2,050

- 7 First Citizen Points/₹100 spent on private label brands at Shoppers Stop

- 5 First Citizen Points/₹100 spent on other brands at Shoppers Stop

- 1 First Citizen Point/₹100 on other spends

- 1 First Citizen Point = ₹0.6 Instantly redeem your First Citizen Points to shop at Shoppers Stop

- Welcome and First-Year benefits worth ₹2,050

- 2 Shoppers Stop vouchers worth ₹250 each redeemable at Shoppers Stop. Each voucher can be redeemed against a minimum spends of ₹2,500 at Shoppers Stop.

- Home Stop voucher worth ₹500 redeemable at Home Stop outlets. The voucher can be redeemed against a minimum spend of ₹4000 at Home Stop.

- Shoppers Stop online store voucher redeemable on shoppersstop for savings of ₹250 on purchases worth ₹1,500 or above. Click here for offer details and terms and conditions.

- Spend anywhere within 30 days of Card issuance and get 500 Reward Points worth ₹300 on your First Citizen Citi Credit Card. Click here for offer details and terms and conditions.

- Joining Fee - ₹500 and Second Year onwards ₹500

- Get 500 First Citizen points worth ₹300 on your first spend within 30 days of card issuance

- Zero Annual fee on annual spends of ₹30,000 or more

- Get Rs. 1000 cash back on spends of ₹5,000 in 60 days of card issuance

- Earn 1 reward point per ₹100 spent on domestic transactions

- Earn Get 2 reward points per ₹100 spent on internationall

- Get free unlimited priority pass lounge access to over 800 airports, worldwide

- Based on your relationship with Citibank, get up to 50% bonus reward points every month.

- Welcome bonus miles worth ₹4,500

- Get benefits worth ₹38,000+ in first year

- Welcome bonus miles worth ₹4,500*

- Taj Group/ ITC Hotels vouchers of ₹10,000*

- Reward points worth ₹24,000** on annual spends

- Never expiring reward points

- Epicure Plan of Taj InnerCircle membership

- Complimentary Priority PassTM lounge access for primary as well as add-on card members

- Instantly Pay with Points at select partners

- Get 1 reward point per ₹100 spent on domestic transactions

- Get 2 reward points per ₹100 spent on international

- Based on your relationship with Citibank, get up to 50% bonus reward points every month.

- On annual spends of ₹24 Lacs. Cashback value per point - 1 rupee. Benefits rounded down to nearest fifty

- Convert to air miles to frequent flyer partners at the rate of 1 point = 4 miles.

- Get free unlimited priority pass lounge access to over 800 airports, worldwide. This benefit applies to primary and supplementary credit cardholders.

- Get 1.5% cashback on all online spends (excluding transfer of funds to online wallet)

- Get 1% on others

- ₹500 Amazon voucher

- 20% off on Swiggy orders above ₹400, Discount up to ₹100, valid once per month

- 5% discount on Amazon spends of ₹1,000 or above, Maximum discount of ₹250 per month.

- Buy-one-get-one-free movie tickets on Saturdays up to ₹250.

- Get 1.5% cashback on all online spends (excluding transfer of funds to online wallet)

- Get 1% on others

- ₹500 Amazon voucher

- 20% off on Swiggy orders above ₹400, Discount up to ₹100, valid once per month

- 5% discount on Amazon spends of ₹1,000 or above, Maximum discount of ₹250 per month.

- Buy-one-get-one-free movie tickets on Saturdays up to ₹250.

- Unlimited cashback on all your transactions

- Second year onwards fee ₹750 will be waived off if you spend more than ₹100,000 in the previous year

- Up to a 15% discount at over 1,000 restaurants across major cities

- Convenient EMI options that allow you to pay your credit card dues in Equated Monthly Installments (EMIs) such as Balance Transfer on EMI, Cash-on-EMI, Loan-on-Phone etc.

- his card is enabled with VISA Paywave technology that allows contactless payments on your credit card.

- 2 Reward points for every ₹150 spent

- Movie ticket voucher worth ₹500 on spending over ₹50,000 in a calendar month. Maximum of ₹3,000 per cardholder in a year

- Get ₹2,000 Cleartrip voucher on first transaction

- 2 Reward points for every ₹150 spent

- Get ₹2,000 Cleartrip voucher on first transaction

- No Joining and Annual Fees

- Movie ticket voucher worth ₹500 on spending over ₹50,000 in a calendar month. Maximum of ₹3,000 per cardholder in a year

- Get 2 Airport Lounge Access to Domestic and International lounges

- 5X Rewards on subsequent purchases made after crossing spend amount of ₹400,000 in an anniversary year up to a maximum 15,000 accelerated reward points.

- Up to 15% off at over 1000 restaurants in major cities.

- Fuel Surcharge waiver at any fuel pump across India for transactions between ₹400 & ₹4,000 subject to a maximum amount of ₹250 per calendar month

- 2 Delight points for every ₹150 spent

- Welcome bonus 500* Delight points

- 1%* fuel surcharge maximum waiver of upto ₹300 per month

- 2 Delight points for every ₹150 spent

- 500 Delight Points on first usage of the card within 30 days, Minimum eligible transaction value is ₹1,500

- 300 Delight Points on first usage between 31 to 90 days from the card issuance date, Minimum eligible transaction value is ₹1,500

- Annual fee – ₹499

- Renewal fee - Nil

- Waiver of 1%* fuel surcharge maximum waiver of upto ₹300 per month

- 2 Delight points for every ₹150 spent

- Welcome bonus 500* Delight points

- Cash withdrawal limit up to 70% of your credit limit

- 2 Delight points for every ₹150 spent

- 500 Delight Points on first usage of the card within 30 days, Minimum eligible transaction value is ₹1,500

- 300 Delight Points on first usage between 31 to 90 days from the card issuance date, Minimum eligible transaction value is ₹1,500

- Annual fee – 499

- Renewal fee - Nil

- Cash withdrawal limit up to 70% of your credit limit

- 2 Delight points for every ₹100 spent

- Flat 10% Cashback on all transactions with minimum ₹500/ within 3 months of card receipt

- 1%* fuel surcharge maximum waiver of upto ₹400 per month

- 2 Delight points for every ₹100 spent

- Waiver of 1%* fuel surcharge maximum waiver of upto ₹400 per month and transactions in the range of ₹400 to ₹5,000

- Get welcome benefit of flat 10% Cashback on all transactions with minimum ₹500/ within 3 months of card receipt.

- You can also earn 500 more Delight Points with just 5 transactions of value ₹1000 each per month.

- Get double Delight points on your Birthday month.

- Complimentary Visa Airport Lounge Access

- Annual fee – ₹899

- Second Year onwards ₹899, waived off if you spend more than ₹90,000 in the previous year

- 2 Reward Points for every ₹100 spent

- Earn 5X Reward Points for dining, entertainment, utility bill payments,fuel and international purchases

- 8,000 Reward points

- 1% fuel surcharge

- 2 Reward Points for every ₹100 spent

- 8,000 Reward points

- 1% fuel surcharge

- Earn 5X Reward Points for dining, entertainment, utility bill payments,fuel and international purchases

- If you spend ₹2 lakhs or more in a year and get 10,000 reward points

- Get additional 10,000 Bonus Reward Points on over ₹3.5 lakhs in a year

- 2 complimentary visits every calendar quarter at domestic lounges at all major airports in India

- Get one complimentary movie ticket free up to ₹200 every month on purchase of 2 or more tickets at BookMyShow

- 5 Reward Points for every ₹100 spent on on domestic transactions

- Earn 5X Reward Points for every ₹100 spent on international transactions

- ₹500 discount on Movie tickets at BookMyShow per month

- 1%* fuel surcharge maximum waiver of upto ₹250 per month

- 5 Reward Points for every ₹100 spent on on domestic transactions

- Earn 5X Reward Points for every ₹100 spent on international transactions

- ₹500 discount on Movie tickets at BookMyShow per month

- 1%* fuel surcharge maximum waiver of upto ₹250 per month

- 2 complimentary domestic airport lounge access every quarter

- 6 complimentary lounge visits in a calendar year using priority pass

- Get complimentary golf rounds in a year and one golf lesson each month

- Distinct guest at Iconic Hotels that give you special preferencesExclusive experiences like Complimentary room upgrade, Early check-in or late check-out, Complimentary additional room nights, Special last minute access

- Priority reservations at Restaurants for Dining Program

- Get an Accor Plus membership with benefits of more than ₹30,000 on spends of ₹8 Lacs in the previous year

- Assured cashback every week worth ₹25*

- 4 movie tickets up to ₹1,000 at BookMyShow

- Fuel surcharge maximum waiver of upto ₹100 per month

- Spend ₹5,000 in a billing month to get 2 free movie tickets

- Spend ₹2,500 in a week, Assured cashback every week worth ₹25* (Scan the QR Code)

- SignUp Bonus worth 4 movie tickets up to ₹1,000 at BookMyShow

- Joining Fee - ₹1,000 and second year onwards ₹1,000

- Fuel surcharge maximum waiver of upto ₹100 per month

- 2 Reward Points for every ₹100 spent on online

- Earn 1 Reward Point on other except fuel

- Spend ₹5,000 in a month, Unlock 10% cashback on BookMyShow, Swiggy & Utility bill payments

- Spend ₹3,000 in a month, Unlock 10% cashback on groceries every month

- Fuel surcharge maximum waiver of upto ₹100 per month

- Spend ₹3,000 in a month, Unlock 10% cashback on groceries every month

- Spend ₹3,000 in a month, next month’s fee of ₹50 is waived off

- Spend ₹5,000 in a month, Unlock 10% cashback on BookMyShow, Swiggy & Utility bill payments

- 2 Reward Points for every ₹100 spent on online

- Earn 1 Reward Point on other except fuel

- Fuel surcharge maximum waiver of upto ₹100 per month

- 5 Travel Points for every ₹100 spent on Travel

- Earn 2 Reward Point on other

- ₹3,000 MakeMyTrip gift voucher

- 0% markup fee on all foreign currency transactions

- 5 Travel Points for every ₹100 spent on Travel

- Earn 2 Reward Point on other

- No Reward Points on International purchases

- 0% markup fee on all foreign currency transactions

- ₹3,000 MakeMyTrip gift voucher

- spend ₹2.5 lacs in a year and get 10,000 bonus Travel Points

- Spend ₹5 lacs in a year and get 15,000 Travel Points

- Spend ₹7.5 lacs in a year and get Taj Experience gift card worth ₹10,000

- 2 complimentary lounge visits every quarter at major domestic airports

- 2 complimentary international lounge visits using your Priority Pass

- Fuel surcharge maximum waiver of upto ₹250 per month

- Complimentary Travel Insurance, Covers on Personal Liability coverage, Trip Delay, Baggage Loss, Loss of Passport, Dental Treatment

- Enjoy complimentary golf rounds

- 10 Edition Cash on every ₹100 spent on Zomato

- 2 Edition Cash on every ₹100 spent food purchases

- Earn 1 Edition Cash on other

- Buy 1 and get 1 movie ticket free at BookMyShow, once a month

- 1.5% markup fee on all foreign currency transactions

- 10 Edition Cash on every ₹100 spent on Zomato

- 2 Edition Cash on every ₹100 spent food purchases

- Earn 1 Edition Cash on other

- 1 Edition Cash = 1 Indian Rupee.

- Spend ₹5,00,000 in a year and get 2000 Edition Cash

- Buy 1 and get 1 movie ticket free at BookMyShow, once a month

- 2 complimentary domestic airport lounge visits every quarter

- Complimentary Priority Pass membership with 2 free international airport lounge visits per year

- Get your annual fee waived off on spending ₹2.5 lacs in the previous year

- 5 Edition Cash on every ₹100 spent on Zomato

- 1.5 Edition Cash on every ₹100 spent food purchases

- Earn 1 Edition Cash on other

- 500 Edition Cash

- Complimentary Zomato Gold membership in your city

- 5 Edition Cash on every ₹100 spent on Zomato

- 1.5 Edition Cash on every ₹100 spent food purchases

- Earn 1 Edition Cash on other

- 1 Edition Cash = 1 Indian Rupee.

- Spend ₹2 lacs in a year and get 2000 Edition Cash

- Complimentary Zomato Gold membership in your city

- 1 HealthCash on every ₹100 spent

- Home sample pick up, Tests include reports on vitamin profile, Thyroid profile, Iron deficiency profile, blood count, diabetes and many more.

- 2 Complimentary Airport Lounge Access per quarter

- Complimentary lounge access on domestic lounges – 2 per quarter